This blog post recaps Runa’s TL;DRs in February and is meant to cover the most interesting token performers, crypto data, and news from the month.

FYI: Runa’s weekly TL;DRs are posted to our LinkedIn account at the end of every week. Follow us on LinkedIn here to get our weekly TL;DRs on your newsfeed.

March was yet another up month for digital assets. With Bitcoin making a new ATH of $73,750 on March 14th before retreating to close the month. March was Bitcoin’s 7th consecutive positive month, an unprecedented run for crypto’s flagship asset.

In March we also saw increased trading activity, a meaningful upgrade to Ethereum, the emergence of new regulatory headwinds and more institutions coming on chain. Here are four of the biggest stories from March:

News Events:

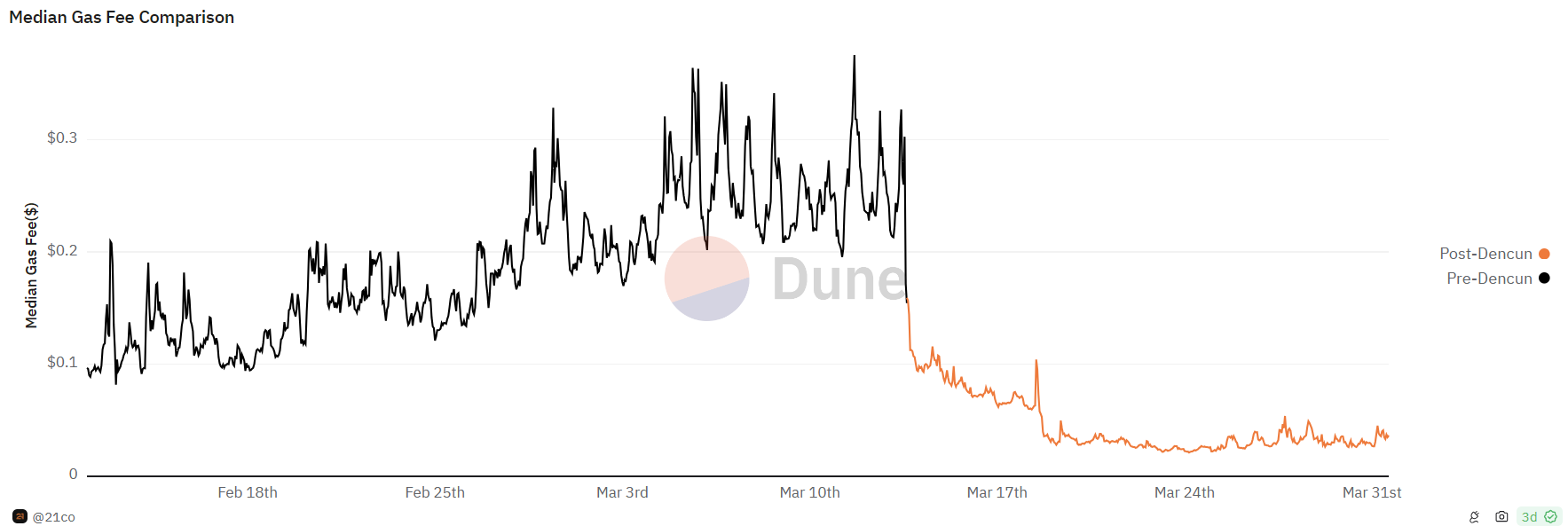

Dencun Goes Live Sending L2 Fees Lower: During March Ethereum implemented its long awaited Dencun upgrade. Dencun considerably lowers data storage costs paid by Ethereum L2s, allowing them to lower the transaction fees they charge to their users. This upgrade has allowed ETH L2s to offer far lower fees encouraging greater usage and experimentation within the broader Ethereum ecosystem.

BlackRock Comes On Chain: This month BlackRock announced the launch of their first tokenized fund on Ethereum, BUIDL. The fund will invest in cash, US Treasuries, and repurchase agreements and marks BlackRock’s first step in bringing their asset management business on chain.

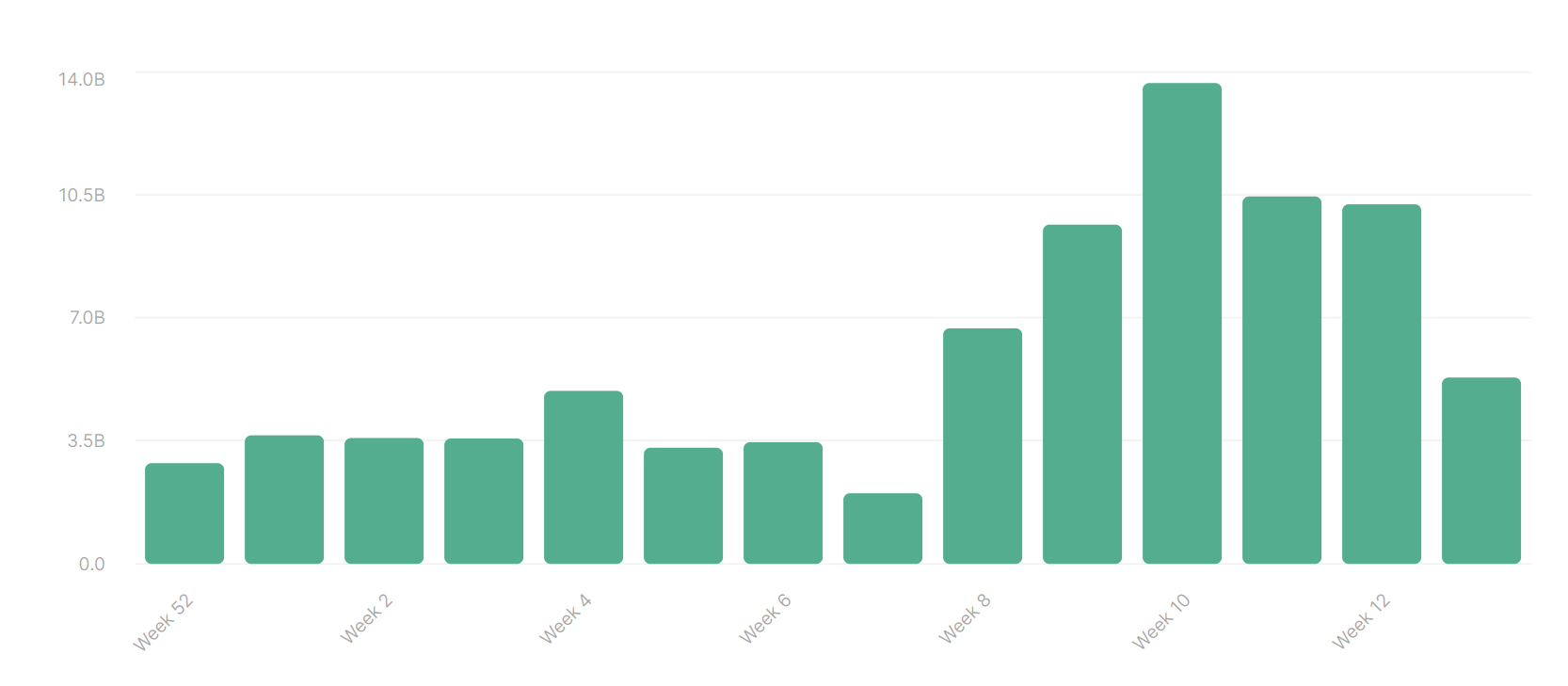

Memecoin Activity Continues: As traders look for new assets to speculate on, considerable volumes have flown into popular memecoins. Many of these assets booked massive returns during March. Notable memecoin leaders for the month include WIF (+330%), PEPE (+117%), and SHIB (+105%).

ETH Faces Regulatory Scrutiny as ETF Deadlines Approach: On March 20th The Ethereum Foundation, the Swiss non-profit which acts as the entity taking the lead in Ethereum’s ongoing development, announced it was facing questions from an unnamed “state authority.” This announcement comes only weeks before the SEC’s deadline to approve or deny various Ethereum Spot ETF applications and indicates those issuers may face an uphill battle to eventually get these products approved.

Notable Token Performers:

Jupiter (+183.6%): One of the most prominent beneficiaries of the memecoin craze has been Solana DEX aggregator Jupiter. Jupiter has quickly become the favored traded destination for most users on Solana, doing over $47B in trading volume during March. As new memecoins continue to erupt on Solana Jupiter will continue to benefit.

Ondo (+93.1%): After BlackRock’s BUIDL announcement the market looked to allocate to real world asset tokenization projects given the endorsement of one of the world’s largest asset management firms. Ondo Finance was one of the most popular ways to play this narrative, and has a direct tie to BlackRock’s efforts given they deposited $95M of their assets into BUIDL to leverage BlackRock’s instant settlement capabilities for their users.

Maker (+86.3%): Maker was an outperformer this month as stablecoin project Ethena continues to shake up the DeFi sector. Ethena offers depositors >30% APYs for depositing ETH or liquid staking tokens such as stETH. These yields largely come from positive funding rates on Ethereum Perpetuals. In order to offer more yield to DAI holders Maker has decided to deposit collateral into Ethena, boosting forward revenue projections for Maker but also introducing increased risks should ETH Perps funding go negative, putting Ethena depositors in jeopardy of experiencing a loss.

Runa Content:

FalconX Webinar: Early in the month Max Williams, Alex Botte, and FalconX’s Head of Research David Lawant gave a report from the front lines of this ongoing war in the smart contract platform sector. You can view a recording of the webinar here and see the full Platform Wars report here.

CAIA Webinar: Alex Botte was a panelist on a recent CAIA “Crypto Check In” in which she and other industry professionals gave an update on crypto markets and their views on some of the most important trends in the space today. You can view the full webinar using this link.

CoinDesk Podcast: Ned Menton provided market color for CoinDesk’s Markets Week in Review Podcast. The podcast can be found on Apple Podcasts or Spotify.

Questions? Thoughts? Feedback? Send us an email! info@runadigitalassets.com