Digital Assets: Opportunity at the Precipice of Change

It’s no secret that the evolution of the “Web” has transformed our world. Its first phase, Web1, opened up the unprecedented availability of information, and Web2’s interactive social and mobile applications created some of the world’s most powerful networks and most valuable companies.

We believe Digital Assets are the dawn of Web3. Digital Assets combine innovations in technology, incentives and governance to create new products/services, organizations and ways to share value. These new permissionless, decentralized global networks will, in our view, also create some of the most valuable networks in the world. And we’re just getting started.

Let’s break it down.

What Is Web 3?

Web3: The Next Major Evolution

Web3 is creating a new kind of collaboration between entrepreneurs, customers, service providers, and investors – empowering users through its decentralized, tokenized networks.

It’s not just a new technology. Web3 offers tools and concepts across industries that enhance and broaden the innovation landscape – an improved approach to infrastructure, incentives, capital structure, ownership, governance and more.

Web 1

Internet (Client/Server)

Innovators:

Web 2

Mobile/Cloud

Innovators:

Web 3

Digital Assets (Distributed Computing)

Innovators:

The Growing Landscape

Web3 has already produced transformational value creators… and it’s just getting started.

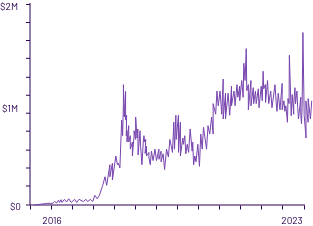

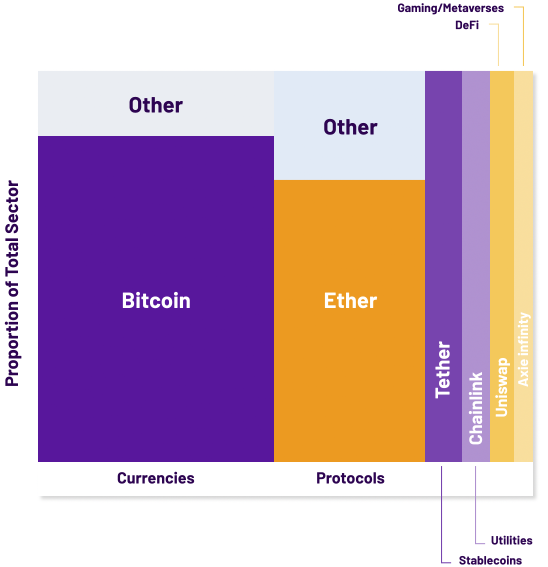

Bitcoin is the first asset in this fast-growing asset class. Launched in 2009, Bitcoin opened the door to cryptocurrencies and innovations that would make possible the launch of Ethereum in 2015 and eventually more than 10,000 listed tokens as of 2022 – more than the number of stocks listed on the NYSE and NASDAQ combined.

The rapidly changing Web3 ecosystem offers increasingly diverse opportunities as innovations spread beyond Finance to the metaverse, gaming, computing and storage utilities, art, collectibles and more.

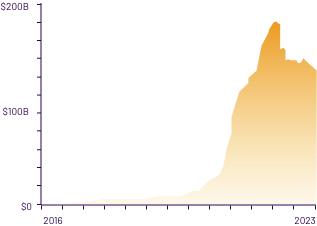

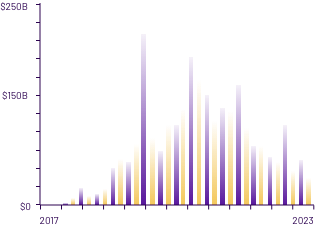

Understanding Volatility

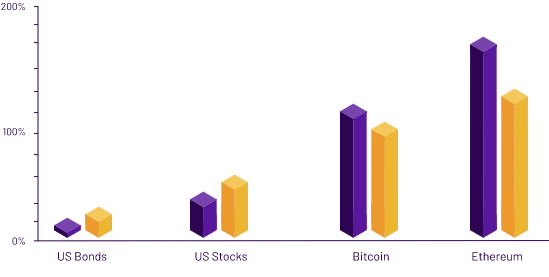

We are experiencing the birth of an asset class – a nonlinear path to progress with an explosion of new projects. Some may be compelling enough to create or disrupt whole industries, but many are likely to miss that mark. The volatility of Digital Assets reflects both the immaturity of the asset class and the wide range of potential outcomes. To date, digital asset investors have been well-compensated for high volatility, and we expect volatility will likely decline over time as the space matures.

RUNA’s Strategy Aims to Capture the Long-Term Upside Potential of Web3. Connect With Us to Learn More.