An Active, Research-Driven Approach to Digital Assets

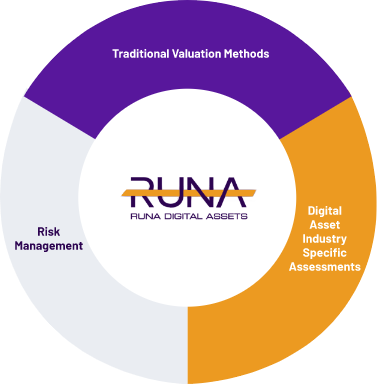

There is a distinct opportunity for long-term investors to benefit from the emerging digital assets ecosystem. At Runa, we believe that an active investment strategy rooted in the best practices of traditional portfolio management, combined with crypto native techniques can provide investors with comprehensive digital asset exposure. Our objective is to deliver long-term appreciation in a risk-managed way to investors who share our vision.

Active Management

The Digital Asset universe is rapidly

innovating and evolving. Our strategy employs flexibility to dynamically manage portfolio exposures and position weights.

Long-Term Horizon

We are firm believers in the long-term value creation that decentralized networks and digital assets have the potential to deliver. We seek to capture the long-term upside in these assets.

Diversification

Bitcoin’s market dominance has

decreased, and as the market continues to evolve, many tokens and sectors are developing unique investment characteristics. We believe a portfolio of tokens diversified across sectors will offer superior risk-adjusted returns.

A Proprietary Sector Framework

We organize the universe along similar traits to better evaluate specific projects and developments. Using a proprietary structure of sectors and sub-verticals helps us manage exposures and risk/return drivers. We pursue opportunities across sectors and themes to realize value as digital assets continue to mature.

Cryptocurrency was the first use of a blockchain to maintain a distributed ledger. The original purpose was to create a digital form of money to transact peer-to-peer without a trusted third party.

The native assets to various “smart contract” enabled blockchains. These protocols were designed as general use blockchains with built-in programmability. The standardization, open-source, and permissionless features allow developers to deploy custom applications with ease.

“DeFi” is one of the largest uses of blockchain technology. DeFi represents the various applications built on smart contract platforms to perform peer to peer financial transactions without a trusted centralized party. Examples include: Lending and Borrowing, Trading, and Insurance.

Utility tokens are used in service and infrastructure networks that are building the middleware layer of blockchain economies. By utilizing blockchain architecture, service providers are able to more efficiently incentivize trustless coordination among participants.

Provable digital ownership and scarcity is one of the more powerful innovations that was spawned out of blockchain technology. This is disrupting the entertainment sector in a variety of ways. One of the most compelling is the development of the “metaverse”, a digital reality world for human interaction.

Stablecoins are tokens that have values pegged to other assets. The most popular stablecoins are pegged to USD, including Tether and USDC. Stablecoins allow holders to keep assets on blockchain infrastructure but are designed to minimize price volatility. More than $100B are held in stablecoins.

Where are you in your learning journey about investing Digital Assets? Runa can help.

Curious to learn more about Runa’s institutional approach to investing in Digital Assets? We can answer your questions.

Sign up to receive our latest writings. Easy to access Digital Assets perspective right in your inbox.