This blog post recaps Runa’s TL;DRs in December and is meant to cover the most interesting token performers, crypto data, and news from the month.

FYI: Runa’s weekly TL;DRs are posted to our LinkedIn account at the end of every week. Follow us on LinkedIn here to get our weekly TL;DRs on your newsfeed.

Crypto Performance

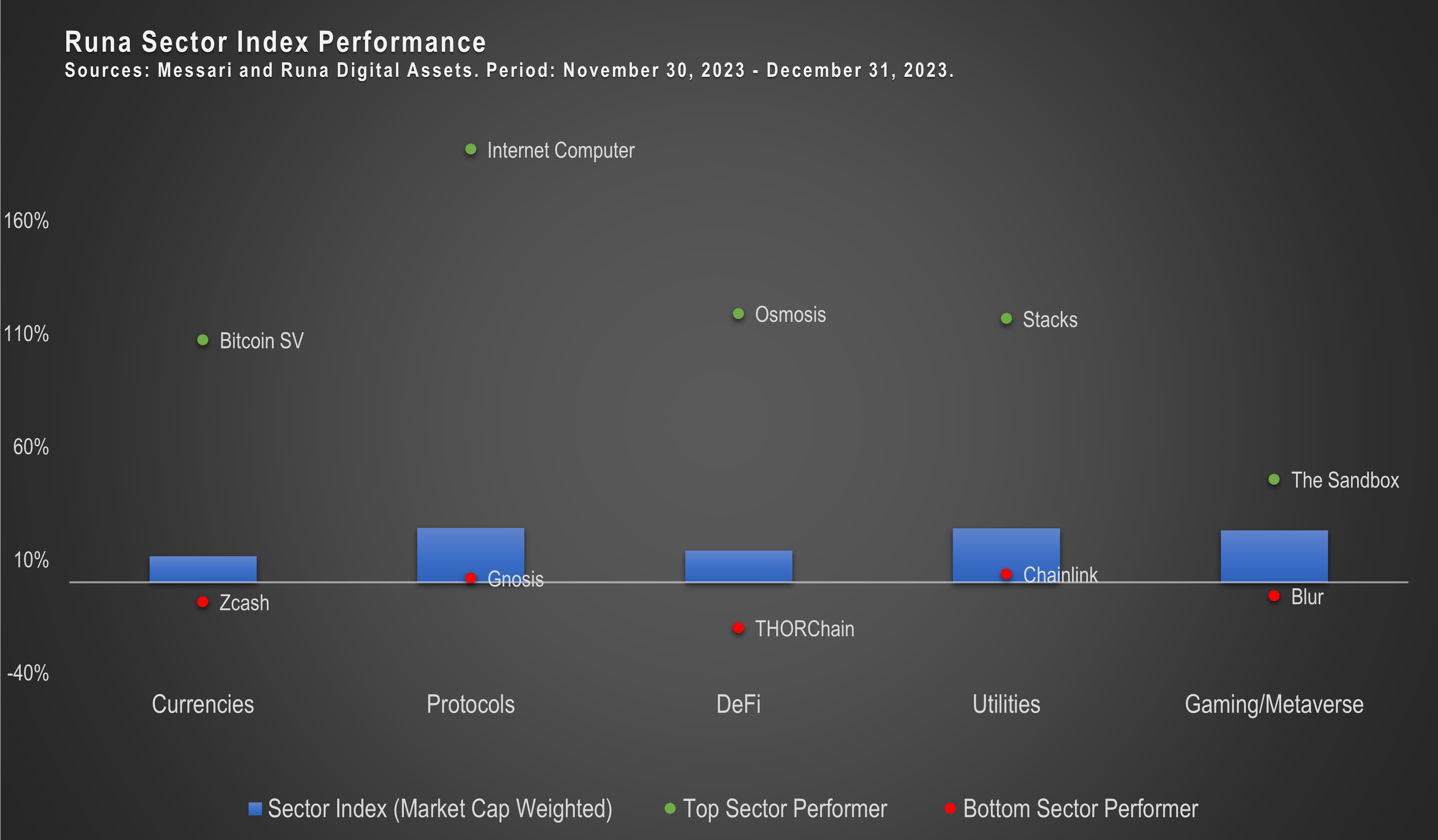

During December digital asset markets continued their strong run of positive performance which has carried us through much of the second half of 2023, with all 5 of Runa’s sector indices positive for the third month in a row.

During this move upward, the market was looking for alternative ways to gain exposure to the Bitcoin ecosystem, as evidenced by Stacks (+117%) and Bitcoin SV (+107%) being the top performers in their respective sectors.

For much of the fourth quarter the possible approval of Bitcoin spot ETFs has been a primary driver of digital asset markets. It seems likely that in January we will learn whether the SEC will accept, reject or continue to delay these applications. While in the short-term digital asset markets will likely be sensitive to the amount of flows there are into these products, in the long term their eventual approval represents a huge step toward institutional adoption for Bitcoin and other digital assets.

Notable Token Performers

Optimism (+122%) Hits ATHs as Dencun Approaches: During December Ethereum developers provided an updated timeline for the implementation of the network’s Dencun upgrade. Dencun will meaningfully lower data storage fees charged to L2s that settle back to Ethereum, significantly lowering their costs and the fees they charge to end users. In response to this updated timeline, L2 tokens rallied with Optimism hitting a new all-time high on December 27th.

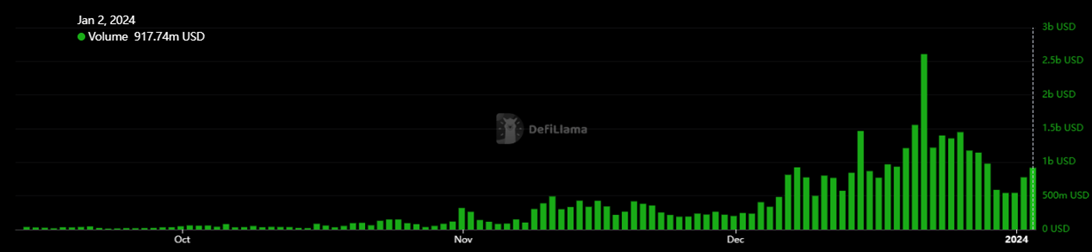

Solana (+71%) Makes Its Comeback: For the last few months Solana has been the subject of renewed market interest as investors revisit the protocol’s tech stack and application set now that the dust has settled on the FTX fallout of last year. With this renewed interest, users are coming back to the chain and applications are offering future airdrops. As these applications’ tokens come out over the next few months these fundamentals are likely to continue to improve.

Solana Total Transaction Volume

Uniswap (+21%) Fees Surge: As the bull market rages on, decentralized exchange activity is picking up as traders return to the space to participate. One of the main beneficiaries of this trend is Uniswap, the dominant decentralized exchange in the Ethereum ecosystem. During December Uniswap charged its users $69M in fees, the highest amount since March of 2023.

Notable Themes

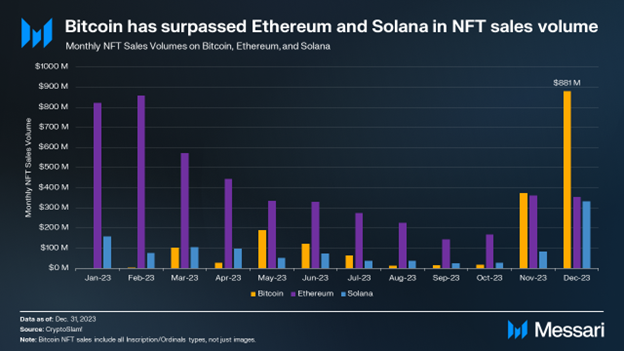

Bitcoin Ordinals Dwarf NFT Markets: Ever since Blackrock’s ETF filing most all of the focus surrounding Bitcoin has been about whether or not the ETF will be approved. However, as this discussion has raged on, Bitcoin inscriptions have continued to grow, with Bitcoin NFT sales volumes exceeding those of both Ethereum and Solana in December. This trend is positive for the network in that it increases demand for block space and fees that can be earned by Bitcoin miners, but many in the community are skeptical of this kind of speculative activity on the Bitcoin blockchain, thinking it could threaten Bitcoin’s primary use cases.

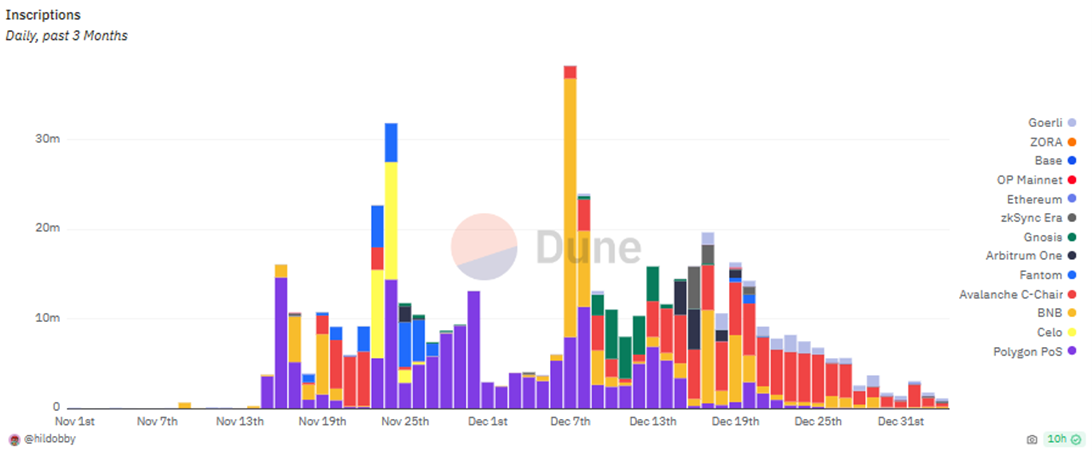

Inscriptions Stress Test L2s: In the middle of the month many Ethereum L2s were beset with inscription activity. Inscriptions first became popular on Bitcoin, allowing users to cheaply inscribe arbitrary data like images or text onto Bitcoin blocks; however during December this activity became a serious threat to many EVM compatible protocols. Seemingly out of nowhere, users began submitting millions of inscription related transactions causing congestion on many chains and even forcing popular L2 Arbitrum to stop producing blocks. Following this stress test, inscription activity went away nearly as quickly as it appeared.

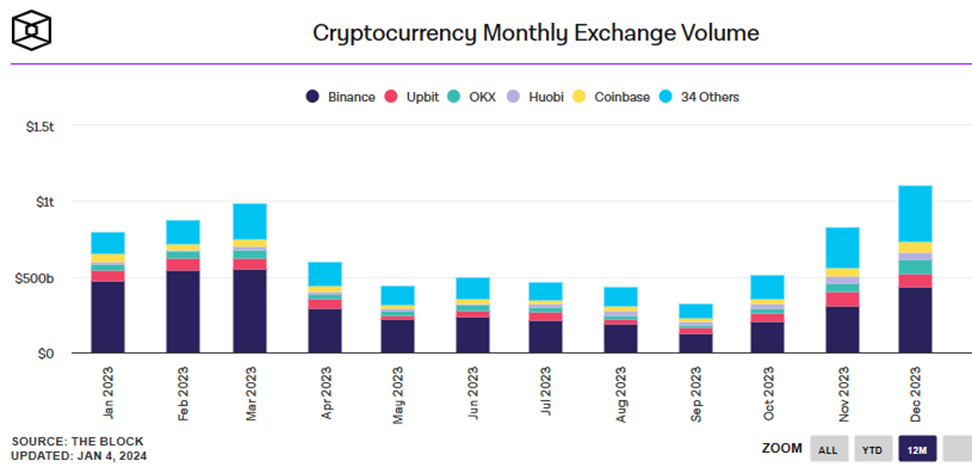

CEX Traders Return: Decentralized exchanges aren’t the only place traders are coming back to. Increasingly trading volume is returning to centralized exchanges as well, with total exchange volume topping $1T for the first time since late 2022.

Argentina Makes First Pro Bitcoin Move: In December Argentina’s Minister of Foreign Affairs confirmed that contracts in Argentina can be agreed and settled in Bitcoin. While only a small step in the right direction, this move could suggest that Argentina’s new president Javier Milei may utilize Bitcoin as a weapon in his all-out war against Keynesian economics and inflationary monetary policy.

Runa Updates

Runa Team Gets Festive with Arbor Digital: During the holidays Max Williams and Alex Botte joined our friends from Arbor Digital and Decentral Park for a holiday AMA. During the call, Max and Alex shared their views on crypto markets going into the new year and answered some of the burning questions in crypto today. You can view the full AMA using the link below.

Click Here to View Holiday AMA

Questions? Thoughts? Feedback? Send us an email! info@runadigitalassets.com