This blog post recaps Runa’s TL;DRs in February and is meant to cover the most interesting token performers, crypto data, and news from the month.

FYI: Runa’s weekly TL;DRs are posted to our LinkedIn account at the end of every week. Follow us on LinkedIn here to get our weekly TL;DRs on your newsfeed.

Crypto Markets

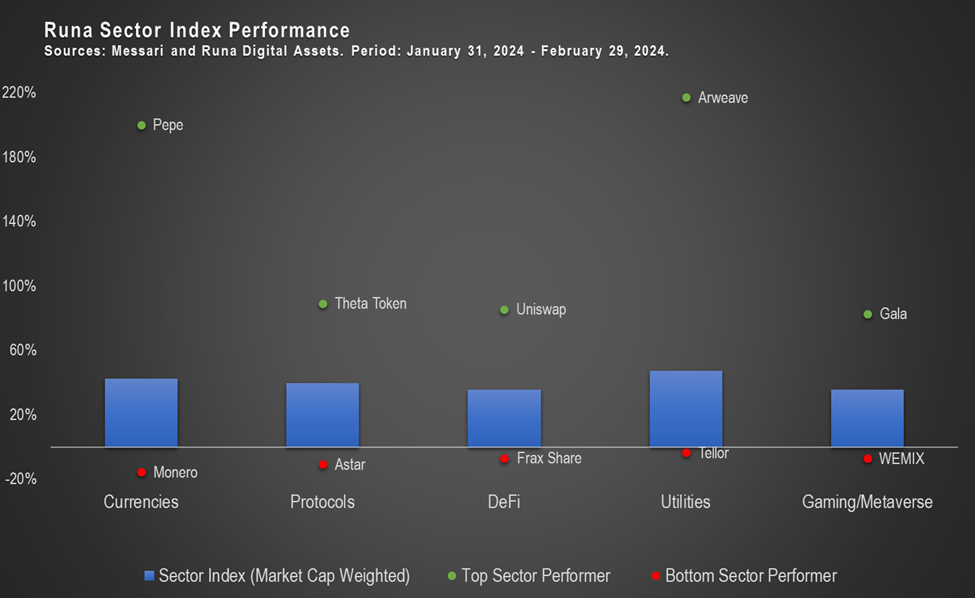

Digital asset sectors were up 36-47% in February. Bitcoin returned 44% – its best returning month since November 2020. It closed the month at $61,175, but on February 28th it closed even higher at $62,545. Bitcoin had only closed this high 17 days before in its entire history.

Three major events propelled the markets forward in February:

Bitcoin ETFs & Futures: Bitcoin continues to experience structural buy pressure from the spot ETFs. In the final week of the month, Blackrock’s ETF, IBIT, consistently traded over $1B daily, smashing its previous average daily trading volume. This is an impressive feat for any ETF, let alone one that recently launched and that has 10 competitors.

In addition to ETF volumes, flows into the ETFs continued to tick higher, netting hundreds of millions of dollars per day. IBIT reached $10B in assets in 5 weeks, much faster than the previous champ, the Gold GLD ETF, which took 3 years. This growth is poised to continue as Bank of America’s Merrill Lynch and Wells Fargo announced on the last day of the month that they will offer Bitcoin ETFs to their clients, unlocking two large new sets of capital.

As we said in our December 2023 monthly letter, we believe the spot ETFs were the most important thing to happen in digital assets since Bitcoin was invented, and even we are surprised by the strength of flows into these products so far. (Click here to subscribe to our mailing list to receive future monthly letters and other research).

Futures markets (perpetuals as well as CME futures) also saw open interest climb over the month, indicating that institutional demand for Bitcoin is growing.

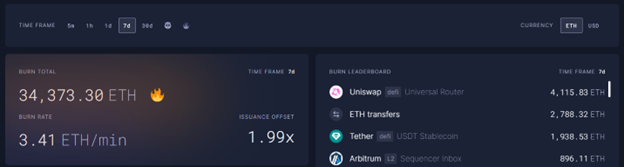

Uniswap: Uniswap announced the protocol’s V4 upgrade is expected in Q3. V4 will introduce “hooks” and other features that will allow pool deployers to customize specific parameters during a pool’s lifecycle. This will unlock monetization opportunities and transform Uniswap from a trading exchange to a liquidity platform.

Additionally, the Uniswap Foundation proposed turning on the “fee switch” so that UNI token holders might begin to receive protocol revenues if they participate in governance. This marks a stark change from the foundation’s stance in the past and would give real utility to the UNI token.

Finally, Uniswap is the application that consumes the most gas on Ethereum today. Ethereum’s upcoming Dencun upgrade will lower fees for L2s, which would benefit Uniswap if more and more users migrate to L2s and use Uniswap implementations on those blockchains. Lower fees and cost savings for end users matter for trading businesses like Uniswap.

Artificial intelligence was spotlighted in stock markets with NVDA returning +29% in February after delivering blockbuster results as a result of rising demand for AI systems. This carried over to digital assets, with Utilities the best performing sector thanks to gains in AI-related names, which were the top 2 performing assets in the sector:

- Arweave (+217%)

- Fetch AI (+160%)

Narratives are extremely important in these markets, and AI is one of the best performing narratives this year behind only Identity.

Other Noteworthy Items

- Ethereum outperformed Bitcoin by 2% in February, perhaps the beginning of a rotation back into the Ethereum ecosystem as we approach the blockchain’s Dencun upgrade and a potential spot ETF approval later this year.

- Solana experienced its first network outage since February 2023, which perhaps contributed to its underperformance relative to the Protocols sector (SOL +30% vs Protocols sector +40%).

- Monero (-16%), a privacy coin in the Currencies sector, was the worst performing asset this month as it got delisted from Binance after it and other privacy coins were placed on a monitoring list.

Runa Updates

- Ethereum faces a growing number of challengers. Max and Alex wrote a comprehensive report on the dynamics at play in the war among smart contract platforms. Read it here.

- Jennifer wrote a piece for CoinDesk that discusses how Bitcoin is an anti-fragile asset that stands to gain from disorder.

- Alex was featured on GlobalStake’s DecentraLounge podcast to discuss real world assets, tokenization, digital asset fundamentals, and crypto’s current killer app. Listen here.

Questions? Thoughts? Feedback? Send us an email! info@runadigitalassets.com