Executive Summary

- Ethereum’s underperformance in 2023 coincided with the rebirth of Solana, setting up a heavyweight fight for dominance in the smart contract platform sector.

- A potential spot ETF, technical improvements, and a new driver of demand could restart the momentum for ETH. But competition is growing, and some upgrades could benefit Ethereum the platform at the cost of ETH the token.

- Solana has re-established itself as the most likely challenger to Ethereum’s throne, but it is mostly built on hype. Solana will need to accelerate its growth rate or Ethereum’s scalability upgrades may widen its moat.

- Layer-2s have garnered traction since coming to the market by offering an Ethereum-like experience with discounted fees. They will soon get the benefit of even lower fees after Ethereum’s Dencun upgrade, leveling the playing field vs. alt-L1s.

- The latecomers are struggling to move the needle on adoption. Alt-L1s are lacking fundamentals to support their high valuations and more competition is coming.

- In our view, Brian Arthur’s theory on increasing returns in the network-based economy provides a helpful framework in navigating the platform wars. Ethereum is currently benefiting from an early advantage, but Solana’s scalability is a threat. Ethereum’s antifragile brand vs. Solana’s speed is the fight to watch.

Ethereum: A Flip in Sentiment

Only in crypto can a token rise 82% in a year and investors are left wondering if something has gone wrong. That was the story for Ethereum in 2023. To be fair, they can blame the inflated expectations – 2023 was supposed to be the year of “The Flippening”, Ethereum’s market cap was going to “flip” Bitcoin’s and become the largest digital asset. ETH bulls believed Ethereum’s use case as a smart contract platform was larger than Bitcoin’s as a global store of value, and Ethereum had many exciting technical upgrades planned during the year to keep its momentum moving full speed ahead.

Bitcoin stopped the music and once again became the belle of the ball. Blessed by Blackrock as ETF eligible, BTC stole ETH’s thunder in a historic year riding a wave supported by a banking crisis that reminded investors of the fragility of the banking system and the value of an alternative. The Bitcoin spot ETF became the market defining event of the year, shifting all attention and investment dollars towards Bloomberg ETF analysts and BTC, respectively. Bitcoin rose 160%, nearly doubling ETH’s performance in 2023 and putting to rest ‘The Flippening” predictions…for now.

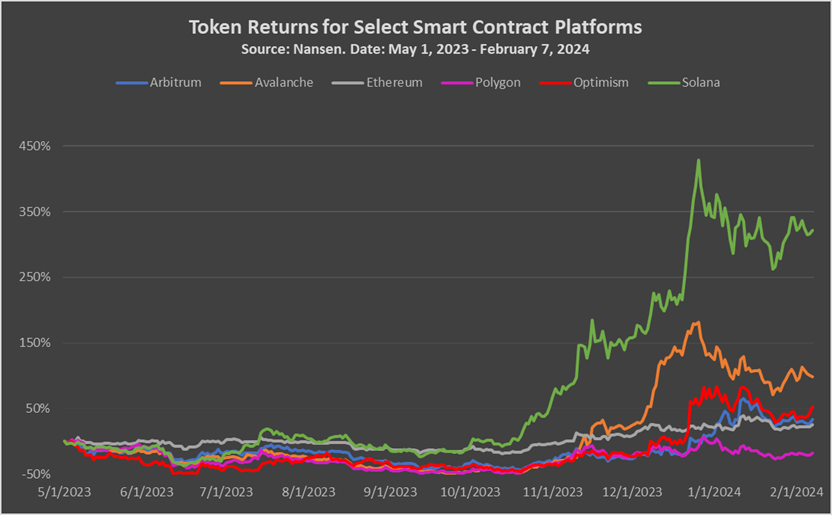

Comparison is the thief of joy, and crypto is more “what have you done for me lately” than the NFL. Not only did Ethereum lag BTC, the only other token considered a “major”, it also lagged other altcoins. Comparing ETH’s performance to some of its peers in the smart contract Platform sector may be the leading cause of concern for ETH investors. This was particularly true in the back half of the year with crypto markets breaking out in Q4, led by alternative Layer-1s (alt-L1s) Solana and Avalanche. Solana’s narrative was re-born, centered around its scalability potential, while Avalanche’s gaming and real-world asset initiatives started to develop. Layer-2’s Arbitrum and Optimism also outperformed Ethereum, likely due to the prospect of reduced transaction fees following Ethereum’s “Dencun” upgrade.

Ethereum was stuck between two powerful narratives. For investors focused on the majors, BTC and ETH, flows shifted towards Bitcoin in anticipation of the ETF, especially one backed by large reputable institutions like Blackrock, Fidelity, and Franklin Templeton. Investors were happy to overweight BTC ahead of the launch to front-run the inflows from TradFi. For more crypto-native investors, the scaling narrative became center-stage once again and the alt-L1 thesis was reborn, led by Solana. Ethereum’s scalability has improved but at a slower pace relative to Solana. “The Flippening” now refers to Solana surpassing Ethereum as the second largest digital asset.

To make matters worse, Ethereum cannot find a way to get rewarded for the improvement it is making on its scaling roadmap. Ethereum made progress on two major upgrades in 2023, launching staking withdrawals (Shanghai upgrade) and releasing the first testnet for Proto-Danksharding (Dencun upgrade). While ETH did rally around both events, the marginal dollar appears to be overlooking ETH in search of higher beta investments like LDO, ARB, and OP. Like an orphaned value investment in a growth-driven bull market, Ethereum is searching for a story to tell.

So… where from here?

The good news for Ethereum is that narratives in crypto change quickly and they have more than a few talking points to get sentiment back on their side. In the first half of the year we see four developments that create opportunities for the Ethereum ecosystem:

- A potential ETH spot ETF

- The Dencun upgrade and proto-danksharding

- The development of restaking driving demand for ETH

- Ethereum’s role as the dominant data availability layer

Each development requires further investigation to understand if the story is as good as the headline.

Ethereum ETF: A Major Win

As mentioned, the Bitcoin ETF developments in 2023 likely served as the driver to BTC’s outperformance. Blackrock kicked the party off in June with their ETF application and BTC rallied 68% from there. Grayscale winning an appeal over the SEC regarding a conversion of their publicly-traded GBTC closed-end trust cleared the path for the approval of spot bitcoin ETFs. Both Grayscale’s lawsuit with the SEC and the SEC’s eventual approval of the BTC spot ETFs in January 2024 appear to have hinged on two key points – 1) the CME and CFTC have classified BTC as a “digital asset commodity”, allowing the trading of futures, and 2) the SEC approved the listing of a Bitcoin Futures ETF in October 2021. With these approvals, it was hard to make the argument for not approving the new applications, and the SEC was deemed by the Court to be “arbitrary and capricious” in denying prior spot ETF applications.

So why is this positive for Ethereum? Ethereum’s ETH token is the only other digital asset that has these commonalities with Bitcoin. ETH futures have traded on the CME since 2021, and Ethereum Futures ETFs were approved by the SEC in October 2023. ETF issuers were not slow to act upon this determination, and many filed ETH spot ETF applications in Q4 2023. These filings will undergo a rigorous review process by the SEC, and a decision is not expected until May. Considering the factors that led to the approval for Bitcoin, we see a high likelihood of approval for the Ethereum spot ETFs.

The impact of an Ethereum ETF is less certain. Ethereum is less understood than Bitcoin by traditional investors, so interest could be muted. Bitcoin has a simple, well-established narrative as “digital gold,” protecting investors against currency debasement. It took roughly 14 years (2009-2023) for this story to take shape and be well understood. Ethereum is younger, launched in 2015, and more complicated. On one hand, it can also be seen as “internet native money” like bitcoin, but on another it is the platform on which Web3 applications are built. While ambitious and exciting, it takes time to analyze and model it – something traditional wealth managers have little incentive to do given the relative size of the asset class. This is evidenced by inflows into the recently launched Ethereum Futures ETFs in October of 2023. In aggregate, those products remain below $100M. When the Bitcoin Futures ETF ($BITO) launched in 2021, it amassed over $1B in AUM within the first week of trading.

Dencun Upgrade: Adding an HOV Lane

Ethereum has long been infamous for its high transaction fees when the network experiences congestion, experiencing transaction fees in excess of $50. This led to the proliferation of “Ethereum challengers” or alt-L1s in the last cycle that touted higher throughput and lower fees. Ethereum’s strategy to combat this threat has been to go ‘“all-in on rollups”.

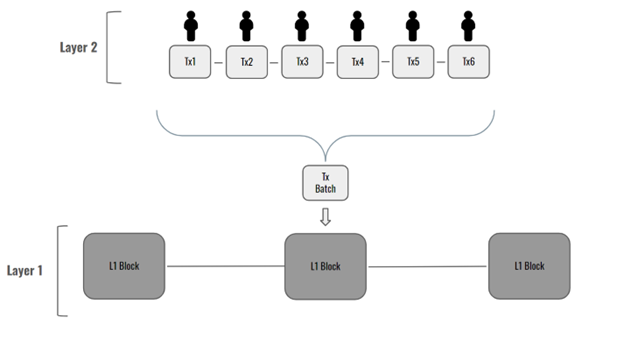

A rollup, more commonly and hereby referred to as a “layer-2” (L2), is a smart contract platform that performs execution off-chain and sends a bundle of the transaction history to Ethereum as the “layer-1” (L1) blockchain to store and serve as a ledger of record to the L2. By processing transaction logic outside of the L1 chain and batching many transactions into a single message, L2s can drastically reduce the transaction cost for the user. The benefit to operating as an L2, and not a standalone blockchain, is the integration with the L1 that allows the chain to inherit the security of the L1 chain since the transaction history is being stored there. By having the transaction history on the L1, users can trust that no malicious activity will occur. Given Ethereum’s large and decentralized validator set and crypto economic security, it is reliably secure.

Layer-2 to Layer-1 Interaction

Source: Runa Digital Assets

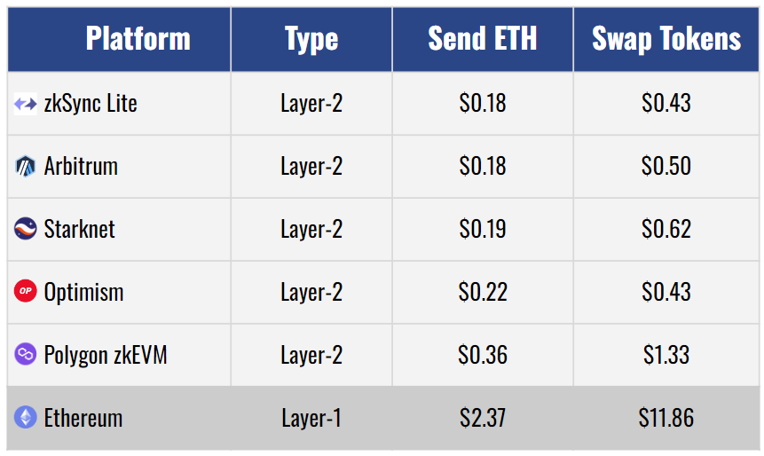

Ethereum, as the L1, does not offer this security for free. L2s must pay the going L1 transaction fee each time they send a bundle of data for storage. Today the data storage fee typically comprises 80-95% of the total transaction costs for a user of the L2. When activity on Ethereum spikes, L2s are competing with transactions on Ethereum itself for blockspace, requiring them to pay higher fees to store data. Under this current architecture, L2s are able to offer transaction costs an order of magnitude cheaper but still not down to sub-$0.05 per transaction, a stated goal and on par with competing L1s like Solana.

Transaction fees by Blockchain

Source: L2fees.info

Enter “Proto-danksharding,” a new feature to Ethereum scheduled to launch as part of the Dencun upgrade on March 12th. Proto-danksharding will create something analogous to an HOV lane for L2s. This will be accomplished by carving out a slice of blockspace, named blobspace, in Ethereum blocks and reserving it for L2s to store their data. Instead of competing with L1 transactions, L2s will now have a reserved lane in each block on Ethereum’s highway. In addition to this, Ethereum will discount the transaction fees charged to the blobspace since it is only using data storage, not the full suite of Ethereum services. Estimates of the impact of such changes vary, but expectations are an end result of L2 transaction fees coming down by 75-90%.

If Ethereum is able to serve users via L2s at costs near $0.05 per transaction, we could see an explosion of activity within the ecosystem: DeFi could see an immediate surge in activity with newly available arbitrage opportunities, the gaming sector, which is throttled by the elevated fee levels, could finally see a breakthrough, and decentralized social could have a potential zero-to-one moment turbocharged by a fee holiday. Proto-danksharding could be the reinforcements Ethereum needs to regain momentum from its competitors. Short term, though, it could turn into a headwind for ETH the asset.

With a newly paved HOV lane, L2s will now be paying up to 90% less fees to Ethereum. An obvious win for L2 chains and their users, but what are the implications for ETH holders? The hope is with a new pricing plan, Ethereum L2s will see a rise in activity across the many sectors previously highlighted. Ethereum is making a rate/volume bet. With fees down 90%, activity must surge 10x to make up for the lost revenue. Is this likely?

We think the effects of this change may take time to work its way through the system. DeFi could be an exception due to arbitrage bots finding new opportunities to execute on that were previously priced unprofitably. In other sectors, there will be a longer lead time for discovery and development. Just look across alt-L1s: none have really discovered a new use case or tapped into a new market by offering extremely low transaction fees. Most of the applications are copies or rebuilds of existing applications on Ethereum. There are some exceptions, decentralized physical infrastructure networks on Solana are showing potential to be a breakout use case of blockchain technology (more on this later).

Without the immediate exponential rise in activity, the fundamental view on Ethereum could suffer. As we wrote about previously, activity drives demand for ETH, and when Ethereum generates more transaction fees than block rewards, the network “burns” the excess ETH earned, creating a similar effect to share buybacks. Proto-danksharding could weaken this in the near term with less ETH being spent by L2s. How will the price of ETH react? Hard to say. Short term, a decline in fee revenue might worry investors. But a rising trend in usage on L2s could demonstrate a path to scale for the Ethereum ecosystem and create a captivating narrative, putting Ethereum and ETH back in the fast lane just in time for the ETF launch.

Restaking

In September 2022, Ethereum underwent a major upgrade to its consensus mechanism when it switched from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) blockchain. We wrote about this upgrade and its investment implications here. This upgrade unlocked what is now the largest DeFi sub-sector: liquid staking. Liquid staking enables ETH holders to participate in the validation of the Ethereum blockchain through staking while also maintaining liquidity of their staked ETH to use elsewhere on the blockchain through receipt of a liquid staking token (or LST).

There is an emerging theme related to liquid staking called restaking that is gaining lots of attention and excitement. Restaking offers a potential offset to any weak Ethereum fundamentals we may see as a result of the Dencun upgrade. The idea is that Ethereum is the blockchain with the second highest security in all of crypto (sitting behind only Bitcoin). Restaking enables other platforms to effectively “rent” Ethereum’s security and network of validators/stakers. It also enables ETH stakers the option to earn additional yield by allowing their staked ETH to be used to validate other services. Of course, there are risks: any ETH tokens restaked to secure other services are subject to slashing effects imposed by those services and Ethereum itself (i.e. higher risks, but also higher rewards).

Eigenlayer is the largest name in restaking. They accept LSTs like stETH, rETH, and cbETH – the owners of which can choose which services to secure in addition to Ethereum. Eigenlayer’s TVL is now $7.7B, and they have 13 services that are effectively renting Ethereum’s security. *

*Sources: DeFi Llama and Eigenlayer as of February 20, 2024.

In the end, the biggest restaking winner in our view is ETH. Ethereum is now able to effectively monetize its high security by renting it out to other blockchains or applications through restaking providers like Eigenlayer. It gives more utility to ETH, and higher yields. As this crypto bull market matures, investors will go further out on the risk spectrum and look for more and more yield. Eigenlayer offers higher yield opportunities on an investor’s staked ETH. The result is more buy pressure on ETH, more inflows into liquid staking protocols like Lido, which will then be deposited into restaking providers like Eigenlayer.

Data Availability

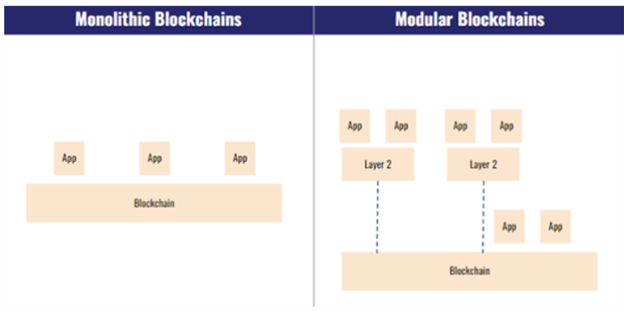

Last year one of our five themes was about scalability and blockchain design. There are four main services that blockchains provide: execution, settlement, consensus, and data availability. As of now we are seeing two different approaches to blockchain design, each of which have different ways of delivering those four services:

- Monolithic blockchains offer all four services in house.

- Modular blockchains separate the four components. L2s, in the form of sidechains and rollups, help the original L1 blockchain scale. For example, L2s built on top of Ethereum saw meaningful adoption in 2023, as discussed earlier in this report, and these rollups offload some of the four services (e.g., data availability) to Ethereum.

Comparing Blockchain Architectures

Source: Runa Digital Assets.

While Ethereum remains the most popular option for L2s to store their data, standalone data availability services have come to market, such as Celestia and EigenDA.* This means that L2s can post their transaction data to these platforms, which guarantee that the L2s’ historical data is available for anyone to check at any time.

*Celestia launched their token, TIA, last year, and it is now one of the largest digital assets with a fully diluted market cap of $18B as of February 20, 2024. Since there is not a ton of activity happening on Celestia currently, the market is pricing in massive growth and adoption. EigenDA is Eigenlayer’s data availability solution.

Standalone providers like Celestia and EigenDA therefore compete with Ethereum itself to provide data availability services to L2s. These standalone services may offer a cheaper option , but that edge is expected to slide after Ethereum implements its Dencun upgrade, which will significantly reduce data storage costs for L2s on Ethereum, as discussed earlier.

One other trend that is relevant to this discussion is application-specific blockchain development. Some applications like dYdX, a decentralized derivatives exchange, have moved from a smart contract app built on top of a blockchain to their own application-specific chain. If we see this trend of apps moving to their own blockchains pick up, that would perhaps benefit adoption of data availability solutions like Celestia and EigenDA, as these app-chains would want to optimize their blockchain infrastructure and potentially outsource each of the four services to the most efficient provider.

What does this mean for Ethereum? As standalone data availability solutions become trusted and adopted, it may be the case that Ethereum loses out on providing this service to L2s and other scaling solutions.

Ethereum Conclusion

Ethereum had a disappointing 2023 from an investment perspective but still trades at multiples higher than the next largest smart contract platform. In our view, it has the fundamentals to support its leading valuation but is losing mindshare to platforms selling the power of potential. While one can hope investor appetite eventually returns to valuing fundamentals, the more likely change is a rerating of Ethereum’s potential.

A possible ETF, restaking, and Dencun each create an opportunity for Ethereum to change the perception of its potential. Ethereum has benefitted from its early traction and established itself as the trusted platform in web 3, but it must adapt in order to stay ahead. The value of its brand and security have carried it this far, but platforms with newer, faster technology are challenging its dominance. If Ethereum can successfully execute its roadmap, the market may value the leader more than ever.

Ethereum’s strategy is heavily reliant on the success of L2s, let’s turn our attention there.

Moving Up: A Look at L2s

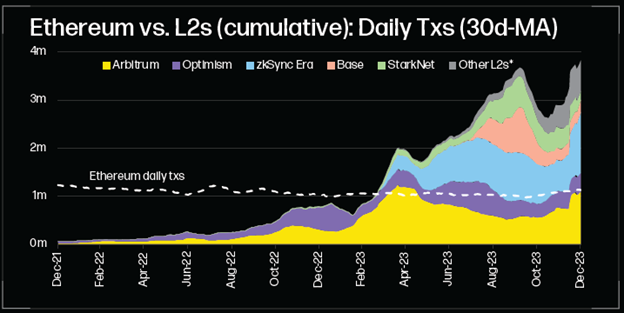

Since Vitalik’s endorsement of the “rollup centric roadmap” in 2020, development and adoption of L2s has continued to accelerate. At that time, high profile teams like Arbitrum and Optimism had just launched their testnets, and just a few L2s had mainnets available to the public. Today, more than 21 L2s are live and aggregate daily transactions are between 3-5x what occurs on Ethereum mainnet.*

*Source: l2beat.com

Daily Transactions by Blockchain

Source: Galaxy Research

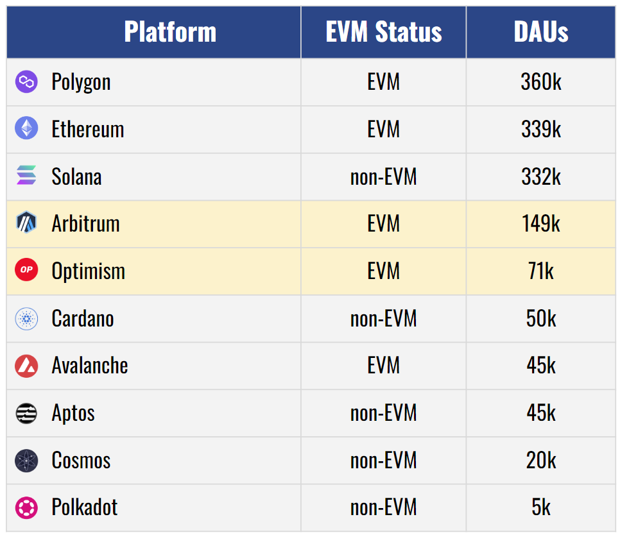

Among L2s, the power law dynamic that has developed in the smart contract platform sector has also taken shape here. The early movers – Arbitrum and Optimism – have emerged as the leaders within the group. Together they account for ~50% of daily transactions and 75% of Total Value Locked (TVL) on L2s*. Adoption of L2s has surpassed many alt-L1s launched over the past five years despite a later start. Arbitrum and Optimism were among the top chains by daily active users in 2023.

*Source: artemis.xyz

2023 Average Daily Active Users by Smart Contract Platform

Sources: Artemis and Runa Digital Assets. Period: January 1, 2023 – December 31, 2023.

In our view, there is a clear explanation for better adoption on L2s compared to many alt-L1s: EVM compatibility and inherited security from Ethereum. Both create a seamless and familiar experience for Ethereum’s existing users and developers.

EVM, which stands for Ethereum Virtual Machine, is the software engine that powers smart contracts on Ethereum. One might compare it to operating systems for computers, like Windows or MacOS. Ethereum has built a global community of users, developers, and infrastructure supporting the EVM that we believe is the moat protecting Ethereum’s position as the leading platform in the sector. The more technical term for this moat might be network effects. Ethereum has more developers contributing to its code than any other crypto project; 87% of all crypto developers contribute code to at least 1 EVM chain; Ethereum has more applications than any other chain; and eight of the top 10 chains by TVL are EVM compatible*.

*Sources: Electric Capital Developer Report, DeFi Llama, Runa Digital Assets

Most L2s wisely leverage this already vibrant community by making their blockchains EVM compatible. This allows for an easy copy-paste deployment for application developers to move their project from L1 to L2 and provide the same service at a fraction of the cost. We have seen many high profile applications deploy across multiple L2s like Uniswap, Aave, and Synthetix, which all deployed on Arbitrum and/or Optimism. L2s are also seeing native development in their ecosystems. GMX, a DeFi application on Arbitrum, never deployed on an L1 and nevertheless rose to become one of the most active exchanges in all of DeFi. Aevo is looking to recreate similar success on Optimism. Base has seen two consumer applications, Friend.Tech and Farcaster, reach scale. EVM compatibility likely explains why Arbitrum and Optimism have had more success than L2s like zkSync and Starknet, who were unable to launch with EVM compatibility. Looking at the top chains by number of applications (another imperfect but measurable proxy for adoption), EVM L2s are among the highest despite coming to market well after the others.

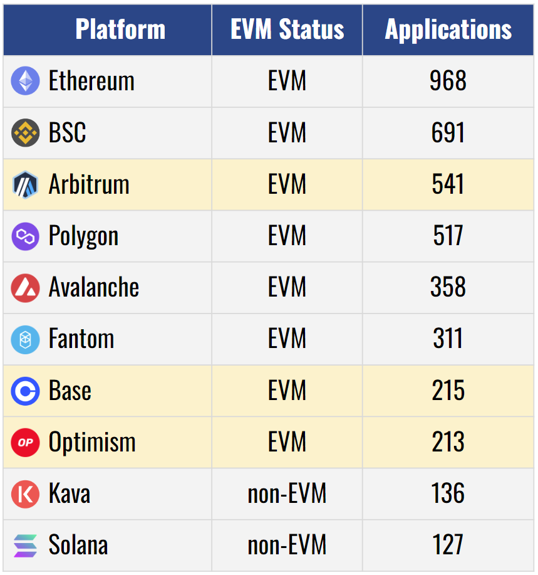

Top 10 Platforms by # of Applications

Sources: DeFi Llama and Runa Digital Assets. As of February 15, 2024.

The other factor driving the success of L2s over alt-L1s, EVM and non-EVM, is the connectivity with Ethereum that provides security assurances to the L2 users. As we discussed in the earlier section on Ethereum, the configuration that allows a blockchain to call itself an L2 is the process by which it sends its full transaction history in bundles down to Ethereum to store and use as a settlement database. By having Ethereum validators participate in this process, L2s gain the security of the Ethereum network which has the highest security value of any smart contract platform. While L2s still have their own work to do before they are truly Ethereum equivalent from a security perspective, the market is willing to bet on their plan. Arbitrum and Optimism’s L1 to L2 bridges each have more than $6B locked in them, more than 3x the next largest bridge*.

*Source: https://l2beat.com/bridges/summary

Proto-Danksharding From the L2 View

Ethereum’s Dencun upgrade, which will deliver proto-danksharding, has the potential to accelerate the growing trend of scaling adoption via L2s. The thinking is simple: proto-danksharding could result in a 90% reduction in fees for L2 users. This permanent fee holiday should open up more opportunities for activity on-chain that is currently being priced out by elevated fees, make L2s more competitive with alt-L1s like Solana and Avalanche, and encourage further migration from L1 to L2. While current applications on L2s are hoping to see an immediate increase in activity, it is the experimentation of new use cases that has us most excited. The triple threat of EVM compatibility, Ethereum-integrated security, and ultra low fees is a narrative that carries real weight with users and developers alike.

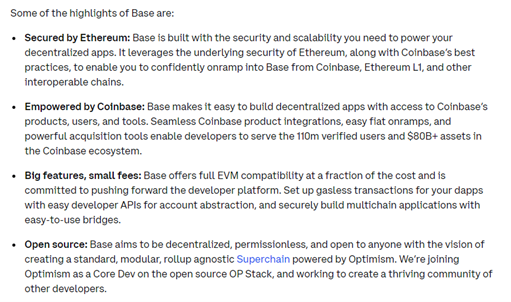

Coinbase, one of the most recognizable brands in crypto, decided in 2023 it was going to extend its reach beyond its role as a centralized exchange and into the emerging on-chain economy. Unafraid to disrupt from within, Coinbase set out a plan to build its own smart contract platform to help facilitate the movement from centralized to decentralized systems. Their team built an Ethereum L2 using code developed by Optimism. The decision to build an L2 was clear: this model offered EVM compatibility, security, and low fees. They call their L2 Base.

Coinbase’s Announcement on Their L2, Base

Source: Coinbase.

Base represents another emerging trend in the L2 landscape, the Rollup-as-a-Service (RaaS) business model. L2s like Optimism and Arbitrum have done the heavy lifting of developing code, cultivating an ecosystem, and securing the almighty integration with Ethereum. While each of them operates as a general purpose L2 aimed at attracting a broad group of users and developers, this strategy can create an inherent limitation on the design space for developers with a specific application in mind. These developers want to take most of what exists, but slightly modify the code to make trade-offs that fit their specific needs. Previously, this meant creating an all new L1 from scratch. Building an application-specific L1 brings a whole new set of headaches – finding validators to provide security, incentivizing them with a token, and maintaining the platform code base in addition to the application. A choice only the well-funded or already successful teams could make. RaaS solutions offered by L2s enable developers to build their own application-specific L2s through “out-of-the-box,” production-ready software that integrates with Ethereum.

L2s were not the first to pioneer this model, known as the modular approach. Cosmos and Polkadot were among the early pioneers. Both aimed to build platforms that acted as a central hub to route transactions between networks of application-specific blockchains. However, this approach required optimizing for scalability at the cost of interoperability. If applications each run on their own platform, interacting between them becomes problematic. Cosmos’ IBC (Inter-Blockchain Communication Protocol) and Polkadot’s XCM (Cross-Chain Messaging) were designed to solve the bridging problem between chains, but neither has come close to matching the size of Ethereum and its L2 ecosystem. Cosmos has seen better traction of the two, likely as a result of their best-in-class software development kit and IBC solutions, but it is not EVM compatible and bootstrapping security was difficult. Polkadot required a large upfront investment from app-chains and has fallen behind on development.

L2s may have found a better strategy to solve the drawbacks of the modular approach. Shared security with support from Ethereum, an out-of-box development kit, and interoperability solutions make for a compelling product. The leading L2s are now focused on attracting applications, or even platforms like Coinbase, to build using their development kits. Coinbase and Sam Altman’s Worldcoin both chose Optimism’s “OP Stack,” Arbitrum has announced their “Orbit” ecosystem, Starkware has the “Starknet Stack,” and Polygon has pivoted their strategy from operating a sidechain to becoming a full stack L2 ecosystem.

Arbitrum and Optimism have established themselves as the marquee L2s with Fully Diluted Values (FDVs) of $19B and $16B*, respectively. Arbitrum leads Optimism in traction on their natively built L2s with more users, TVL, and applications, but Optimism has had more success in the RaaS model, securing partnerships with Coinbase, Worldcoin, and Binance to build platforms using their “OP Stack.” But with zero-knowledge (zk) technology, viewed as the superior choice compared to the tech used by Arbitrum and Optimism, maturing at a much faster rate than expected, we think Polygon might establish itself as a formidable challenger. While their natively built L2, dubbed the “Polygon zkEVM,” has not generated much interest since launch in early 2023, their RaaS vertical is making headway. Immutable X, a leading gaming platform, Canto, a real world assets platform, and OKX, a market leading exchange, have all signed on to join Polygon’s L2 ecosystem. We believe Polygon could be better positioned in the RaaS model due to their advancements in zk technology. Through zk proofs and the “agg-layer”, Polygon will be able to offer seamless interoperability between app-chains and a pricing structure that is more optimized for scale. From our perspective, Polygon is currently being valued as an struggling alt-L1 when in reality it is rapidly evolving into an L2. Polygon’s MATIC token trades at a ~50% discount to ARB and OP on an FDV basis, making it an attractive candidate for a relative value trade.

*As of 2/20/2024

Will Ethereum Challengers Get a Second Shot?

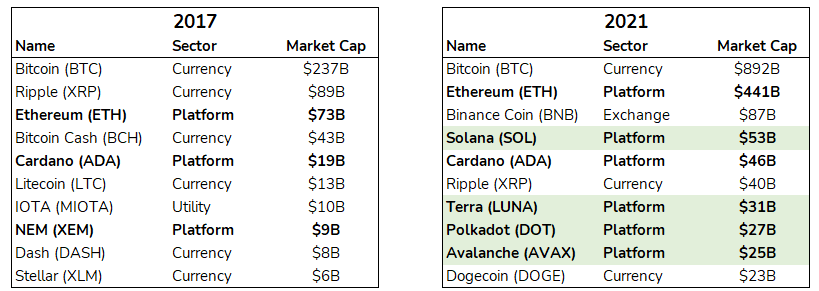

In this report we’ve talked a lot about “alt L1s” – smart contract platforms that threaten Ethereum’s dominance. This group was an important market narrative during the last crypto bull cycle (2019-2021). Solana, Avalanche, and others challenged Ethereum, and their tokens grew meaningfully in market cap to enter the top 10 tokens near the market peak in late 2021.

Top 10 Tokens by Market Cap

Source: CoinMarketCap. Excludes stablecoins.

Will these previous challengers (and/or new ones) get another chance this cycle?

Solana’s Rise From the Ashes

Solana (SOL) made a major splash in the last bull market. As we saw in the last exhibit, it was the largest new smart contract platform to enter the top 10 in 2021 by market cap. The following year (2022) the digital asset markets overall did not fare well, and Solana was no exception. There were implosions across the industry from Terra Luna to Celsius to Three Arrows, but of course the largest of them all was the demise of centralized crypto exchange FTX. FTX, its founder, Sam Bankman-Fried, and its hedge fund, Alameda Research, were all invested in and proponents of Solana. Bankman-Fried even co-founded one of the largest DeFi applications at the time, Serum, and FTX and Alameda Research both held meaningful amounts of SOL on their balance sheets. It’s no surprise then that SOL crashed following FTX’s implosion in November 2022. On top of all that, Solana was also plagued by 14 outages throughout 2022*. This eroded trust in the network. Sure, one of the differentiators for Solana is its lower transaction fees and higher throughput compared to Ethereum, but it is difficult to entrust capital to a blockchain with that much downtime. As a result of these troubles, Solana saw fundamentals like TVL as well as its token price fall dramatically.

*Source: https://status.solana.com/uptime

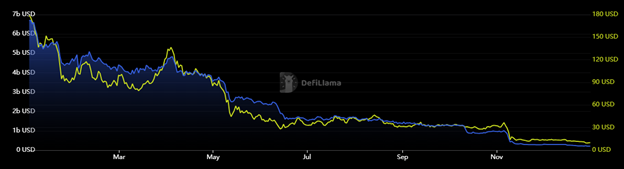

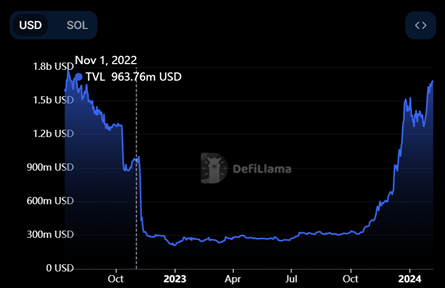

Solana TVL (Blue) and Token Price (Yellow) in 2022

Source: DeFi Llama.

Projects like DeGods, y00Ts, and Lido left the Solana ecosystem, moving to competing blockchains.

2023 was a different story. Solana “rose from the ashes” and made a major comeback. The SOL token went from $10 to start the year to end just over $100. Its 920% return outperformed BTC by 765%. What led to this resurgence? We’ve published research showing crypto markets fundamentals often do not lead price – in fact it may be the other way around – and this Solana case study is no exception.

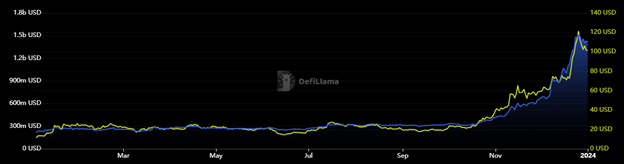

Solana TVL (Blue) and Token Price (Yellow) in 2023

Source: DeFi Llama. TVL and SOL price in USD terms.

Recovery in Solana’s fundamentals (such as TVL) followed the token’s price appreciation last year. Airdrops from projects like Pyth Network, Jito, and Jupiter have led to more excitement about Solana, bringing people back to the ecosystem, trading on Solana’s decentralized exchanges, and re-igniting DeFi activity. How sustainable is this rally, and what do the network’s fundamentals look like today across payments, DeFi, and non-DeFi activities?

Solana: Payments and Stablecoins

One of the use cases of blockchain technology is payments. Blockchains like Solana offer a number of advantages over traditional payment systems, including decentralization, security, transparency, efficiency, and lower costs. Users of blockchains oftentimes use stablecoins – or digital assets whose value is linked to some external reference asset, most commonly the US Dollar – for payments-based use cases on blockchain rails.

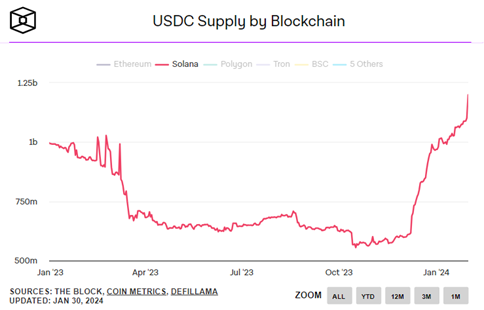

One of the largest stablecoins is USDC, which is managed by Circle. USDC’s market cap on Solana has reached a 12-month high of $1.2B (about 4% of USDC’s supply across all blockchains, including Ethereum).

USDC Supply on Solana

Source: The Block as of January 31, 2024.

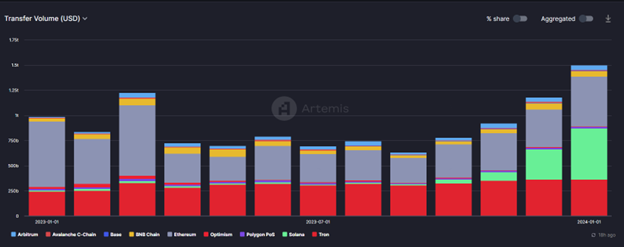

The transfer volume of stablecoins on Solana has also grown significantly recently. As of January, Solana had the greatest transfer volume share across all blockchains.

Monthly Stablecoin Transfer Volumes Across Blockchains (Solana in Green)

Source: Artemis as of January 31, 2024. Note that there has been some skepticism surrounding the reliability of this metric and whether it is artificially high due to a central limit order book program on Solana.

While there are several potential reasons behind the increase (e.g., higher DeFi activity and NFT volumes, which we’ll get to later), one of the drivers is Solana Pay, which is an open, free-to-use payments framework built on Solana, and is available as an approved app integration on Shopify. A few hundred merchants are using Solana Pay today. * Solana Pay has many benefits for merchants, including incredibly fast settlement times (less than a second) and lower costs (only $0.00025 per transaction plus the ability to avoid credit card fees).*

*Source: The Solana Foundation as of January 5, 2024.

*Source: VanEck Monthly Crypto Recap for August 2023

Solana’s stablecoin volume is poised to continue as another traditional financial institution, Visa, experiments sending stablecoins on the Solana network. After diligencing the major blockchains, Visa decided to allow its partners to send or receive USDC via Solana to boost the speed of cross border payments.

Solana: DeFi Comeback?

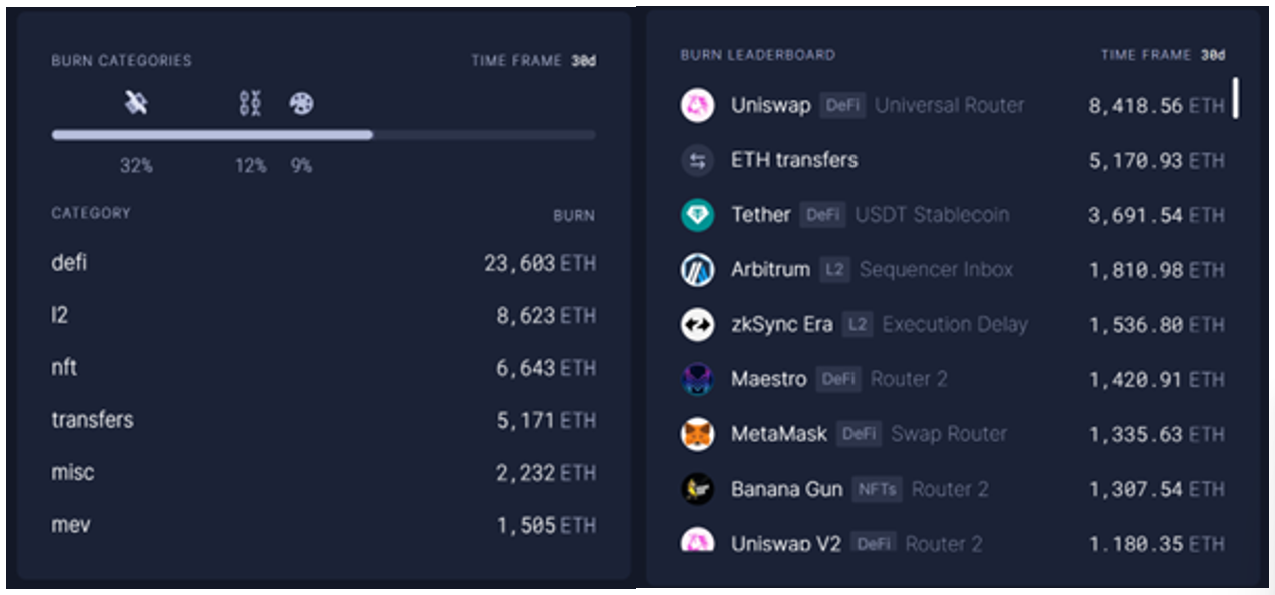

We believe that DeFi is the sector that has found the most product market fit for blockchain technology to date. Speculative trading, oftentimes involving leverage and/or derivatives, is one of the most widely used use cases of smart contract platforms today. For example, DeFi is the #1 source of gas fees on Ethereum, far outpacing other categories like NFTs and L2s, and Uniswap (a decentralized exchange or “DEX”) is the application that uses the most gas fees on Ethereum.

Sources of Ethereum Gas Fees by Category and Application

Source: https://ultrasound.money/ as of February 6, 2024. Period is the prior 30 days. Ethereum gas fees are burned (i.e. removed from total token supply).

As we mentioned earlier, Solana’s DeFi ecosystem was decimated after FTX imploded in November 2022. TVL (in USD terms) was ~1B right before FTX and reached a low of 210M – a -78% decline. TVL today sits at 1.8B, making more than a full recovery post FTX. Of course, this has been aided by appreciation in SOL price as well, but regardless the DeFi ecosystem on Solana has made quite a comeback.

Solana TVL Recovery Since FTX

Source: DeFi Llama as of February 6, 2024. TVL in USD terms

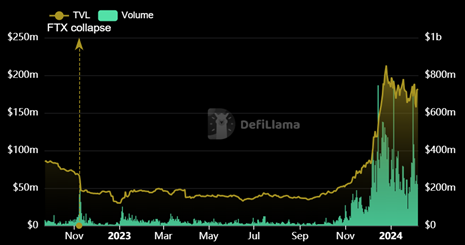

We believe that DEXs are a beneficiary of bull markets – speculative traders return with higher prices, improving sentiment, more airdrop activity, etc. The largest DEX on Solana today is Orca (think of Orca as Solana’s Uniswap), and we already see both its TVL and trading volumes moving up and to the right.

Orca TVL and Trading Volume Recovery Since FTX

Source: DeFi Llama as of February 6, 2024. TVL and volume in USD terms.

Solana’s DeFi fundamentals are moving in a positive direction following appreciation in SOL price, and we will continue to monitor these types of fundamentals to evaluate the health of Solana’s DeFi ecosystem. In terms of selecting the winners within Solana’s DeFi ecosystem, it might not be enough to simply look at the evolution of a more mature chain like Ethereum for a clue. As we mentioned in this post, some parts of Solana’s DeFi ecosystem are already exhibiting differences relative to Ethereum in terms of DeFi user behavior as well as the types of applications that are dominating.

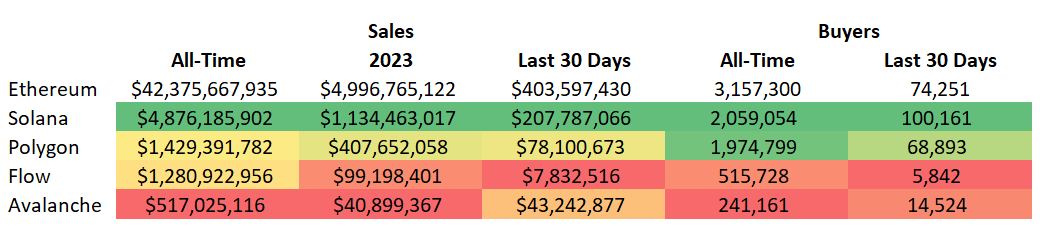

Solana: NFTs

While DeFi effectively died on Solana post-FTX, the blockchain was kept alive and relevant by NFTs. NFTs represent a key new innovation in crypto over the last market cycle – a novel primitive that enables more than just profile pictures of pixelated punks and bored apes. NFTs are a token standard that enables digital property rights and ownership of any content type, and has the potential to disrupt many industries including gaming, fashion, music, and ticketing.

Art collections like Mad Lads, games like Star Atlas, and decentralized physical infrastructure networks like Helium and Hivemapper all utilized NFTs on Solana during 2023.

NFT Sales and Buyers

Source: CryptoSlam as of February 8, 2024.

We believe in the future NFTs will be more about abundance than scarcity, but one barrier to massive NFT growth has been the cost of “mints,” i.e. producing an NFT. There has been experimentation of different token standards on Solana, one of which is “compressed NFTs,” which move the storage of NFT metadata (e.g., image url and traits) off-chain. This innovation has driven the cost of minting NFTs down by a factor of 1,000x+ (from $10+ on Ethereum to <$0.001 per mint on Solana).* Solana, as a low fee, high throughput blockchain, is well positioned to be successful with mainstream Web3 consumer use cases that utilize NFTs.

*Source: Modular Capital

Solana: Conclusion

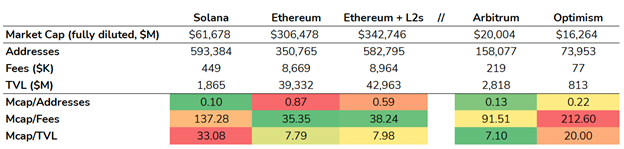

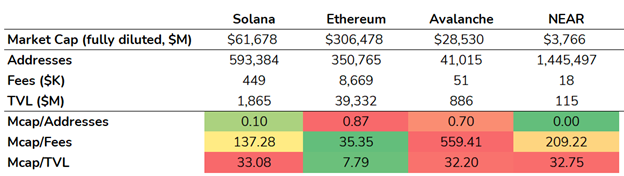

Let’s delve into the core fundamentals of Solana and conduct a comparative analysis with Ethereum alongside some of Ethereum’s prominent L2 solutions. It’s crucial to recognize that Solana operates as a unified blockchain system, encompassing all essential blockchain functions in-house such as execution, settlement, consensus, and data availability. Conversely, Ethereum has embraced a modular framework, scaling via L2s, which manage certain blockchain functions while relying on Ethereum for others, as discussed at length in the Ethereum section of this report.

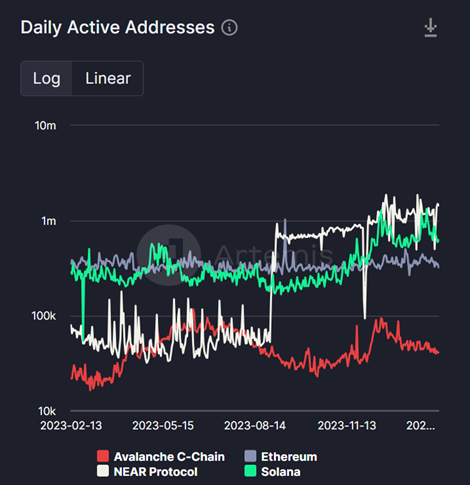

Regarding its fundamentals, Solana demonstrates notable strength in daily active addresses, surpassing the combined metrics of Ethereum, Arbitrum, and Optimism. However, Solana lags behind Ethereum in fee generation and total value locked (TVL), despite showing the promising growth in its DeFi ecosystem that was discussed earlier.

Even though Solana appreciated 920% last year, it still trades at approximately an 80% discount to Ethereum. While its address multiple seems appealing, other multiples using fees and TVL suggest that Solana may be overvalued. Notably, there may be more lucrative investment opportunities via applications built on Solana rather than the blockchain itself.

Solana vs Ethereum: Fundamentals and Valuation

Sources: CoinMarketCap and Artemis as of February 12, 2024. Ethereum + L2s include Ethereum, Arbitrum, and Optimism. Chains built using the Arbitrum and Optimism tech stacks (e.g., Base) are excluded from this analysis.

The valuation of Solana seems to reflect optimism regarding its future prospects, possibly driven by anticipation surrounding initiatives like Firedancer (a new Solana feature) and Solana Saga (its mobile offering). Additionally, the expectation that Solana’s lower fees and higher throughput will position it favorably as the preferred blockchain for emerging consumer applications contributes to its perceived value. However, it’s imperative for Solana to address network reliability issues, reducing outages and downtime to enhance its “antifragility.” Stress testing the network under high congestion, potential hacks, and attacks will be pivotal in reinforcing Solana’s resilience.

EVM Compatible Alt-L1s: Avalanche and NEAR

Let’s now turn our attention closer to the Ethereum ecosystem by looking at two of the largest alternative EVM compatible L1s, Avalanche and NEAR. Both chains rose to prominence during the last bull cycle of 2020-2021, experiencing significant growth and attention within the crypto space. However, like many other projects, they faced challenges as the market waned in 2022. Despite this downturn, both Avalanche and NEAR have shown resilience and posted strong recoveries in recent months.

Avalanche’s recent momentum is at least partly a result of a focus on institutional business development, gaming, and real world assets. Inscriptions, which are data (text, videos, images, etc.) inscribed on a blockchain’s native coin, originated on Bitcoin, but the idea found its way to other networks including Avalanche. This inscription activity contributed to the surge in Avalanche’s fundamentals in Q4.

Avalanche presents a subnet model that allows for customizable networks purpose-built for specific functions, resembling L2 tech stacks like the OP Stack and Polygon’s CDK mentioned earlier. These subnets are self-governing networks, part of the broader Avalanche ecosystem, and carry out blockchain services such as execution and settlement, resulting in a horizontal implementation of the modular blockchain structure (compared to Ethereum’s vertical implementation with L2s). Additionally, the subnets can be permissioned, which is an attractive option for financial institutions experimenting with blockchain technology. For instance, WisdomTree, T. Rowe Price, Citi, and Cumberland have utilized Avalanche for experimentation.

Given its similarities to Ethereum’s L2 solutions, Avalanche raises questions about whether institutions and decentralization applications will opt for L2s or Avalanche.

NEAR, another EVM compatible smart contract platform competing with Ethereum, offers its own unique features. Similar to Avalanche, in Q4, NEAR exhibited impressive performance, outpacing the market in terms of token appreciation and certain blockchain fundamentals. A noteworthy surge in daily active addresses, driven by inscriptions as well as adoption in fitness, gaming, and social applications, underscored NEAR’s recovering ecosystem. New technical offerings, including a data availability solution developed in partnership with Eigenlayer and a “zkwasm” collaboration with Polygon, further bolstered NEAR’s appeal.

Adding in EVM Compatible L1s: Fundamentals and Valuation

Sources: CoinMarketCap and Artemis as of February 12-13, 2024. Avalanche is represented by the Avalanche C-Chain, the piece of the network that executes smart contracts.

NEAR Surges in Daily Active Addresses; While Ethereum is a “Steady Eddy”

Source: Artemis as of February 13, 2024. Period: 1 year. Avalanche is represented by the Avalanche C-Chain, the piece of the network that executes smart contracts.

As these two chains compete with other L1s to attract developers and protocols, positioning themselves as potential infrastructure for the mass consumer use case or application, it’s essential to consider the challenges and uncertainties that lie ahead. While their scalability, specialization, and compatibility with the Ethereum ecosystem are attractive, the competitive landscape of blockchain technology is dynamic and evolving rapidly. Only time will tell how Avalanche and NEAR will fare attracting developers, users, and entrepreneurs in a crowded and ever-changing environment.

Finally… Everything Else: From Move to “Next Gen” L1s

In the realm of L1 blockchains, the competition doesn’t end there. Several new entrants are vying for users, applications, and developers.

Notable among these are Aptos and Sui, distinguished by their utilization of the Move programming language, a departure from the languages employed by Ethereum (Solidity) and Solana (Rust). Move originated from internal development efforts within Facebook/Meta for the Diem stablecoin project, which was eventually abandoned. So these chains were not necessarily born out of a direct market demand for increased block space but rather an unused supply of intellectual property. They seek to offer a competitive edge in scalability and suitability for DeFi applications, with aspirations to also attract gaming developers. Interest in Aptos and Sui in late 2022 and through 2023 was in part fueled by speculation about their potential to emulate Solana’s success in the previous cycle. The adoption of these platforms by developers is potentially hindered by the necessity to acquire proficiency in a new language, impeding network effects.

In addition to these Move chains, another recent cohort of L1s has emerged, focusing on high speed, throughput, and EVM compatibility. Examples include SEI, which optimizes for trading use cases, Monad, an ultra-performant option due to its architecture, and Neon, an EVM compatible blockchain built on Solana that offers the benefits of Ethereum’s smart contracts as well as the speed of Solana.

Fundamental Metrics of New vs Old Gen Blockchains

Source: Artemis as of February 15, 2024. Period: 3 months.

Ultimately, the success of any blockchain hinges on adoption and network effects. These newer chains’ fundamental metrics have ticked up recently (again in part due to inscriptions) but are still far behind the incumbents. Their technical advantages may not be enough to attract users and developers away from the established, battle-tested networks of earlier generation chains, which have vibrant communities and the benefits of the Lindy effect.

Final Thoughts

Brian Arthur’s work on the shifting dynamics in the new economy as it moves from one of diminishing returns to one defined by increasing returns is a helpful framework for thinking about the sector. Smart contract platforms are networks at the most basic level and will benefit from the concept of increasing returns that come with scale. More users attract more developers, which attract investors, who fund more developers, and on goes the flywheel. Ethereum recognized the early potential in smart contracts and was among the first to market with imperfect but innovative technology. This allowed them to ride the waves of DeFi summer in 2020 and begin to lock in as the platform of choice despite their rivals emerging with new and innovative technology. As the theory on increasing returns explains, an early advantage creates a self-reinforcing mechanism that begins to compound and may make what appears to be an illogical choice the dominant one.

Whether we have seen this lock-in effect yet is up for debate, and even if we have it will not last forever. Relying on path dependency and a first mover advantage is a fast way to fail. Solana is on the heels of the Ethereum ecosystem and building a loyal following. Solana has what it takes to unseat a locked-in platform by Arthur’s standards – lower fees and higher speeds. But it lacks the established brand that Ethereum cultivated through the DeFi revolution and the emergence of NFTs that got the whole world understanding Web3. If Solana can establish its brand value faster than Ethereum can solve its scaling bottlenecks, then we could see a passing of the torch. While this is reasonable to predict, it is not our base case for now.

The same opportunity exists for many other smart contract platforms, but they face a tougher fight than Solana. They are yet to show much traction, and Solana’s success may actually harm their chances. But since we have yet to see a “killer app” in Web3, they still have their chance to unleash a secret weapon.