As digital asset markets battle a large market downturn, liquidations, and bankruptcies, Ethereum’s upcoming Merge offers the potential for light at the end of a cold crypto tunnel. In fact, we think it is the most important event of 2022 for crypto investors.

What is The Merge and why should investors care?

The Merge can be viewed as a software upgrade that, if successful, will change how Ethereum processes transactions on its blockchain. While this will benefit Ethereum in the long run, the performance of the blockchain will only see marginal benefits for now. Where the upgrade will really be felt, is in the demand for ETH the asset. The Merge will cause a shift in supply and demand that reinforces the investment merits of ETH in ways digital assets have never seen before.

Casper, Serenity, ETH 2.0, and now simply just – The Merge. Ethereum’s upgrade to Proof of Stake has been in development long enough to have four different official titles. The good news is Ethereum developers are making tangible progress on the upgrade with successful Merge simulations on testnets, and the September 2022 target date seems more realistic than any prior estimation. Investors would do well to take notice.

Mining Vs Staking

Ethereum, like Bitcoin, currently uses Proof of Work (PoW) as part of its consensus mechanism to determine who will propose the next block of transactions to be appended to the blockchain and confirmed by the network. Since blockchains are permissionless (anyone can participate) and distributed computing systems, there is a need to prevent spam from degrading the network. Proof mechanisms institute the requirement for economic resources to participate in block production. Participants are rewarded for providing the network with the safety and security it needs. Proof of Work is a cryptographic proof that requires one party, referred to as a “miner”, to solve an algorithmic puzzle before they can submit a block to the network. This puzzle requires large amounts of computing power gained through hardware and energy expenditure. Proposing a valid and accepted block results in a reward of tokens for completing the work. For Ethereum this reward is 2 ether (ETH) tokens. If a miner completes the puzzle but proposes an invalid block, the rest of the network will veto the block resulting in wasted computing energy with no block reward issued, a net loss for the miner. These economic incentives have been successful for both Bitcoin and Ethereum to ensure the liveness and security of their networks.

The much-publicized drawback to a Proof of Work system is the amount of energy required for continuous operations. Bitcoin for example has been estimated to consume 0.5% of global electricity production. Ethereum, which was started years after Bitcoin in 2013, recognized this and from its earliest days proposed to begin as a PoW network but eventually migrate to Proof of Stake (PoS). The economic resources required to submit blocks in a PoS network are the tokens native to the network otherwise known as a “stake”. For Ethereum, a stake of 32 ETH is needed to participate in block production as a validator. Rather than having to solve a computing puzzle, validators are chosen at random to submit blocks to the network. Like PoW, once a block is proposed it also must be confirmed by the rest of the network. Malicious behavior in a PoS network is punished through “slashing,” which is the burning of a bad acting validator’s tokens thus reducing their stake.

There are many more nuances involved in comparing PoW to PoS, and I recommend reading here if you want to learn more on these mechanisms.

I believe there are three core reasons which led to the Ethereum community choosing to move forward with the PoS path:

- Energy Usage – PoW requires 99% more energy than PoS. While blockchains and Web 3 are important, adverse climate impact and energy consumption should be avoided if possible. Ethereum as a PoW blockchain is an anomaly among Smart Contract Platforms which mostly use PoS. Ethereum felt the network could operate just as well, if not better, as a PoS network compared to PoW, all while reducing energy usage by up to 99%.

- Operating Costs – Since PoW requires miners to continuously spend money on maintaining or upgrading hardware and using electricity, they must be incentivized with high rewards to offset costs. Rewards are paid in native tokens to the network and therefore increase token supply. Ethereum currently issues 4% of its supply to miners each year. Stakers in a PoS system have far less fixed costs and therefore do not need as high of rewards to participate. Reducing expenses of the network should result in a higher valuation, and we will spend time on this later.

- Starting the scaling roadmap – A switch to PoS had been planned dating back to 2015 and was discussed even earlier. Delivering the upgrade eventually became phase 0 of a grander vision to upgrade Ethereum to a new and improved “2.0” version that included technical design changes to massively scale throughput. Once The Merge is complete, developer effort will shift towards scaling upgrades. To be clear, The Merge is phase 0 and only provides a clear roadmap to improving scalability but is not expected to offer scaling benefits itself.

The Investment Upgrade

Likely more interesting to the readers of this report is how this will change ETH from an investment perspective. We see two benefits to ETH as a result of the Merge:

Supply and Demand Imbalance – Ethereum will have a drastically lower new token issuance rate as a PoS chain. This drop in supply issuance combined with Ethereum’s burn mechanism could make ETH deflationary and put natual buy pressure on the token, as long as current demand continues.

Value and Fundamentals – The story and similarities to an equity investment become clearer. A case can be made for valuing ETH in ways that are familiar to traditional asset managers who have long been skeptical of how to value digital assets. A model that uses network fundamentals can demonstrate a clear and understandable way to value ETH as an investment. Lastly, in a PoS world ETH becomes a productive asset yielding an estimated 6%-10% annually to stakers.

Supply and Demand

Ethereum is different from Bitcoin in many ways but one that may be surprising to some is that Ethereum’s token, Ether, does not have the same fixed supply that Bitcoin has. While Bitcoin has a supply limit of 21 million tokens, ether has an uncapped supply. Until last August, this meant that supply was scheduled to grow at roughly 4% per year in perpetuity. To understand the impact of changes being made we must first understand the flow of fees and rewards that occur in each block.

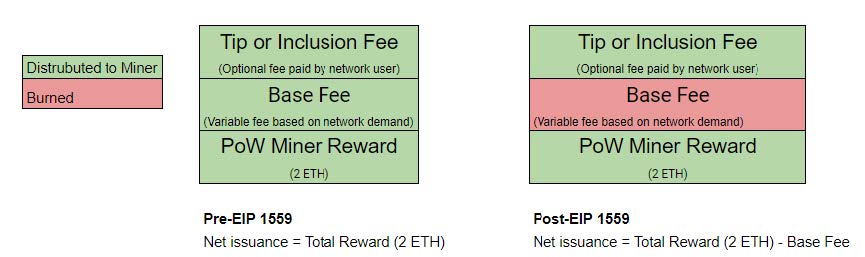

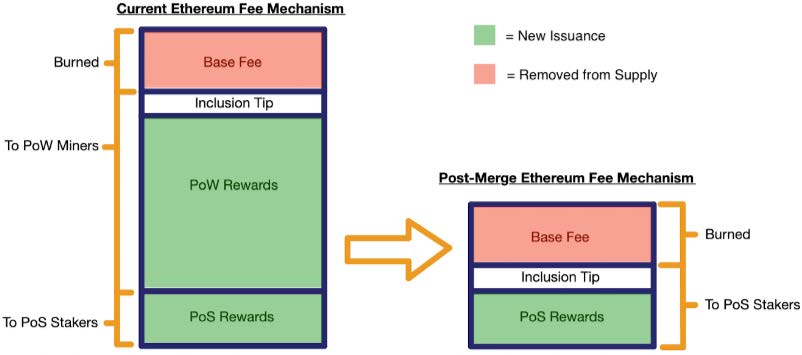

There are three components: block rewards, the base fee, and the inclusion tip. Base fees and tips are paid by network users, while rewards are newly issued tokens.

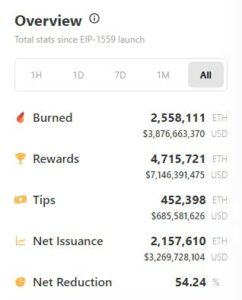

In August 2021, Ethereum approved an improvement proposal (EIP-1559) that modified the fee mechanism and distribution of tokens in each block. One portion of the total fees in each block are now burned (removed from supply) instead of being passed along to the miner who added the block. Since EIP-1559 went live, Ethereum has burned 2.5M tokens, or about 2% of current outstanding supply.

Source: watchtheburn.com

The fee component that is burned is the base fee, better known as “gas fees”. The base fee is a dynamic fee determined on a per block basis and fluctuates based on activity on the network. When activity increases, the base fee increases, and ETH is burned in larger amounts. The net result since August has been a 54%reduction in supply issuance than would have otherwise occurred. Ethereum has experienced a halving event like what Bitcoin undergoes every 4 years.

Reducing the flow of new supply also reduces some of the natural sell pressure created by token issuance but does not eliminate it completely. As mentioned earlier, miners have fixed costs, namely hardware and energy spent on computation, that are typically paid for with token rewards. Chainalysis, a blockchain analytic firm, estimates that 80% of mined ETH is sent directly to centralized exchanges. In a PoS network the bulk of your costs are one-time costs to aquire your stake. Validating in a PoS network is not the arms race mining is in a PoW network, once staked you have almost no costs to participate in block production as running a validator can be done on a home computer. Since this process is far less intensive, the rewards issued to incentivize participation are also lower. Ethereum’s issuance to stakers is 90% lower than what is currently paid to PoW miners. The block reward is not fixed at 2 ETH per block in PoS, rather it is dependent on the total amount of ETH staked. Using other PoS networks as a benchmark, we can assume that stake rate should stabilize at or around 50% in the near term. At 50% staked, Ethereum’s new supply issuance will be 1,600 ETH per day, far less than the ~15,000 tokens issued under the current PoW system.

Putting all the above together results in a structural shift in the supply and demand dynamics of ETH. Assuming current demand holds, the post-merge net issuance per block on Ethereum will become negative. More ETH will be burned per block than issued to stakers. Burning ETH is best equated to a share buyback in corporate finance. Outside factors excluded, ETH now has natural ongoing buy pressure from token burns instead of the natural sell pressure it currently experiences from issuance to miners. As we all know, price is set by supply and demand, and Ethereum’s balance could be moving sharply in one direction.

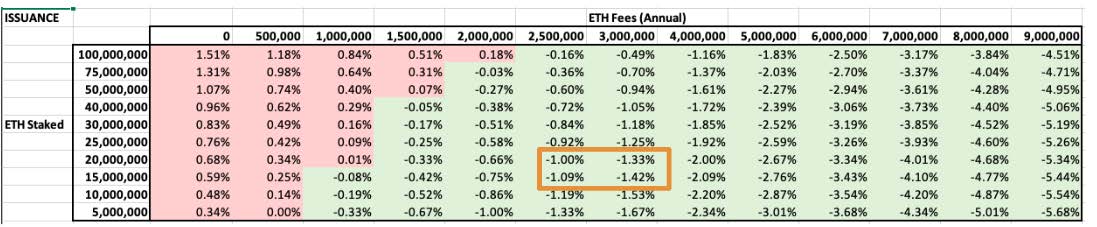

There are risks that the token burns do not overtake issuance to miners and Ethereum continues as the inflationary network it is today. Activity on the Ethereum network is coming down from its 2021 highs. For the Merge to have the structural demand shift outlined above, we will need activity on Ethereum to maintain current levels or increase. The below table shows issuance scenarios at different fee levels. As network activity increases, Ethereum generates more fees which are then burned, reducing net inflation to deflation territory. At current fee generation levels, we are expecting annual inflation of ETH to be around -1% post-merge.

Source: @vivekventures, Runa Digital Assets

Proof of Valuation

Fidelity recently released a study on digital assets for institutional investors and 44% of investors cited “lack of fundamentals to gauge appropriate value” as a barrier to investment. This is not surprising as investors in other markets have long relied upon the work of our predecessors to assess value in markets using models and frameworks like EPS, NPV, and DCFs. In a frontier market like digital assets, we have no such agreed upon principles to fall back on. But with Ethereum’s move to proof of stake and corresponding adjustment in monetary policy combined with serving as the foundational platform of the digital economy, we can start to build a model that shows growth in fundamentals leads to direct value creation for its token holders.

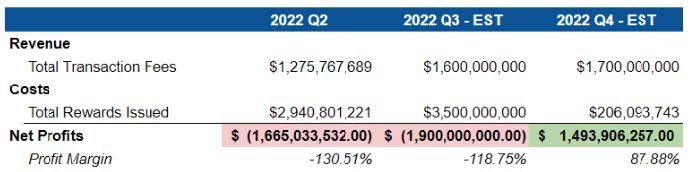

As we discussed above, Ethereum charges fees (base fee) to those who use blockspace on the network, this will be our top line revenue. For the bottom line, Ethereum pays rewards to network validators who provide security and production of blocks, this is the network’s expense to sell blockspace. Currently paid to both miners and stakers but soon to change. Expenses are paid through dilution of the network similar to Share-Based compensation in equity markets. We can use this framework to build a modified DCF model.

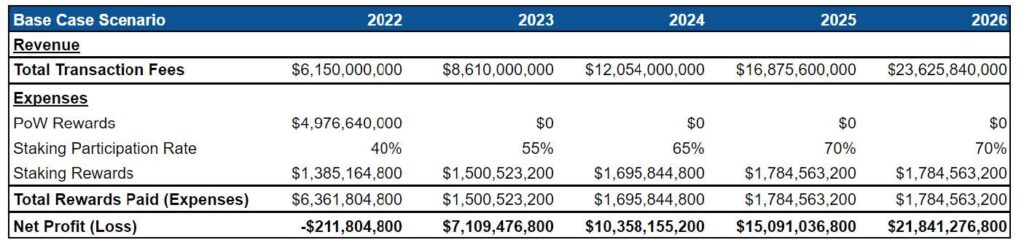

To build this into a model we calculate revenue by using historical averages of transaction growth and average base fee per transaction.. To model what expenses will be, we will need to estimate the validator participation rate. Looking at other PoS networks we can assume an initial rate of 40% growing each year to eventually reach a stabilization rate of 70%. We will also model in the Merge taking place at the end of Q3 2022.

Looking at the QoQ model to highlight the immediate impact of the Merge:

Source: Etherscan, Runa Digital Assets

Extrapolating this into a longer-term view using Ethereum’s historical 40% growth rate:

Source: Etherscan, Runa Digital Assets

In a complete simplification of the model – when demand for blockspace exceeds the rewards paid to validators to produce blocks, Ethereum buys back (burns) more tokens than it pays in expenses. Thus, the network operates at a profit. In Ethereum language: When base fee > validator reward = token burn > block reward = net reduction in supply of the network.

This “merges” two concepts together that traditional investors have long been questioning in digital assets. Are fundamentals and value at all linked to one another? For Ethereum to operate at a profit, it must attract enough activity that base fees exceed stalking rewards. Fundamentally, we can view this through transactions, fees, and users. We think this simplified and familiar framework to valuing an investment will be compelling to investors regardless of their opinion on digital assets.

Now this model is not perfect and should not be used solely to determine the value of ETH. The first issue being that fees and expenses are paid in ETH not USD. So, to convert them to USD we need to provide a value for ETH, which is what we are trying to solve for, making the model circular. The other issue is unlike traditional equity shares, profits are not directly distributed to token holders. Rather “profits” here are used to burn tokens outstanding and reduce the overall supply. More of an indirect cash flow but similar in nature.

The move to proof of stake will create an additional value for token holders that does not currently exist under proof of work – yield. In a PoS network the rewards (expenses) are paid to those who stake their tokens and validate blocks for the network. As a token holder, you are now eligible to become a validator and earn said rewards. Even better, staking is seen as much less technically challenging and intensive as mining and plenty of StaaS (Staking as a Service) providers exist who would gladly offer a home to your stake in return for a cut of your rewards.

The yield is expected to be in the 6% – 10% range when including each element of block production – rewards, inclusion tips, and MEV. Assuming, as a long-term investor you are willing to stake your token, you are now rewarded with a stock dividend yield in the high single digits. Pretty good for your investment in a high growth technology platform.

Conclusion

Telling a clear story is essential for any investment process. Prospective investors like to know what they need to believe for a successful investment thesis to come true. One could argue that Bitcoin’s rise to institutional portfolios only happened when the narrative of “digital gold” caught on. I believe post-merge, Ethereum will have the fundamentals to show it is an emerging technology platform with a clear path to generating value for its investors.

We should not forget the benefits of the Merge that do not show up in financial models. The primary driver of the Merge is to make Ethereum more energy efficient and ESG friendly. If you have been following the digital asset space you have most likely seen headlines about Bitcoins energy usage. While most of them are exaggerated, it is always something Bitcoin will have to dispel to the public. Ethereum, as a PoS network, will reduce its energy consumption by 99% and be comparable to a home television. Investors dismissing ETH for ESG reasons will need to reconsider later this year.

An exciting but challenging road lies ahead for Ethereum. A successful Merge will represent the largest overhaul to a live blockchain network we have ever seen. A change that has been years in the making and comes with no shortage of technical risks and complexity involved. With this change though, the investment narrative for ETH becomes as strong as any crypto asset – the foundational layer of the growing digital economy, ESG friendly, demonstrable value capture, and yield bearing.

Click here to download a PDF version of this article.

This article (i) is only for informational and educational purposes, (ii) is not intended to provide, and should not be relied upon, for investment, accounting, legal or tax advice, and (iii) is not a recommendation as to any portfolio, allocation, strategy or investment. This article is not an offer to sell or the solicitation of an offer to buy any securities or other instruments.