This blog post recaps Runa’s TL;DRs in September and is meant to cover the most interesting token performers, crypto data, and news from the month.

FYI: Runa’s weekly TL;DRs are posted to our LinkedIn account at the end of every week. Follow us on LinkedIn here to get our weekly TL;DRs on your newsfeed.

Crypto Performance

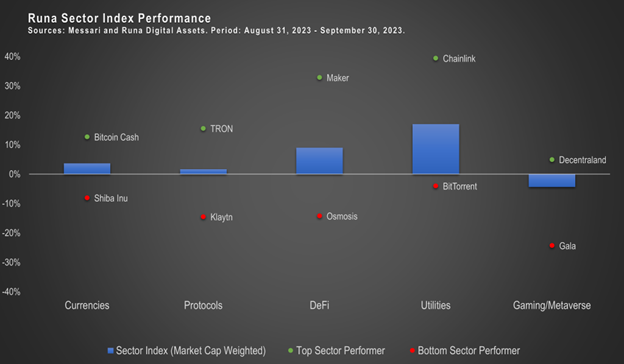

During September 4 of Runa’s 5 sector indices booked a positive month while the Gaming and Metaverse sector continued to underperform the market at large, with September being the sector’s 8th month in a row in the red.

September (like many other months we have experienced) was defined by regulatory developments. The developments were almost entirely centered around digital asset ETFs. At the end of August, Grayscale had just won their lawsuit against the Securities and Exchange Commission (SEC), seemingly clearing the way for a BTC spot ETF.

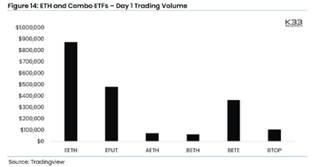

Following the excitement surrounding this win, a series of ETH Futures ETFs were approved in September. Despite these wins, regulatory pressures still loom large over the industry as both the CFTC and SEC took enforcement actions against market participants during the month.

Notable Token Performers

- Maker+Centrifuge: During September some of the best performing assets within the DeFi sector have been tokens with Real World Asset (RWA) offerings. Both Maker (+33%) and Centrifuge (+42%) were up >30% during the month as the market continues to exhibit excitement around RWAs coming on chain.

- Gala: The worst performer of the month was gaming marketplace Gala (-24%). Gala’s gross mismanagement led to this underperformance, as the project’s co-founders are currently suing one another, both claiming the other has misappropriated funds and harmed the future of the project.

- Chainlink: Web3 oracle Chainlink (+39%) was the top performer within the Utilities sector as the market continues to react positively to the protocol’s new Cross Chain Interoperability Protocol (CCIP).

Notable Data

- Weak ETH Futures ETF Trading Volumes Post-Launch: One of the main narratives pushing markets upward toward the end of the month was the approval of a series of ETH Futures ETFs. Commentators and traders were excited about the release of these products, however upon their release trading volumes were shockingly low, further illustrating the broad apathy which has taken hold of crypto markets.

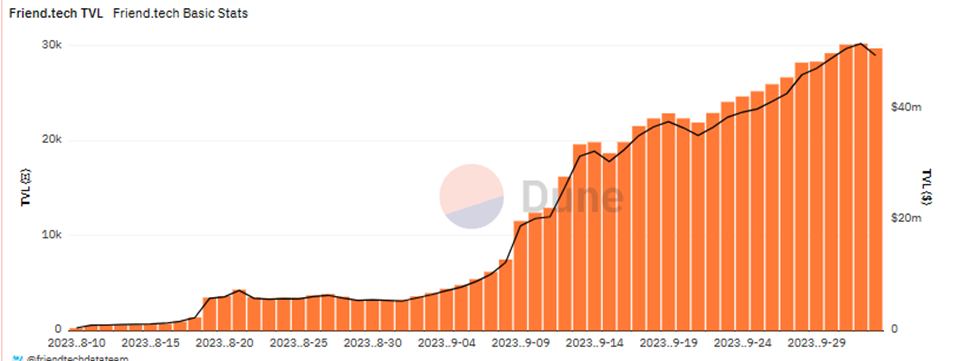

- FriendTech Growth: September saw the acceleration of the growth of Web3 social platform FriendTech, with TVL exceeding $50M at the end of the month. FriendTech’s growth is a validation of value prop of Web3 social media platforms and has greatly impacted growth of Coinbase’s Ethereum L2 Base.

Notable News

- Citi Expands Digital Asset Offerings: During the month Citi announced the expansion of their digital assets business. Now the bank will provide digital asset payment solutions to their institutional clients. This announcement marks yet another traditional finance firm recognizing and embracing the value of digital asset technology.

- Google Partners with LayerZero: LayerZero Labs announced they have partnered with Google Cloud. Through this partnership Google Cloud will become LayerZero’s new default oracle operator. This partnership adds considerable security to LayerZero and is further evidence of how Google is looking to make inroads into Web3.

- SEC Comes After NFTs: The Securities and Exchange Commission announced they had charged the creator of the “Stoner Cats” NFT collection for conducting what they referred to as an unregistered offering of NFTs. The charges relate to the 2021 minting of Stoner Cats NFTs, in which the firm sold 10,000 NFTs for ~$800 each. This action is concerning for the NFT market at large given that the Stoner Cats mint was very similar to most in the industry.

- CFTC Cracks Down on DeFi: The CFTC brought enforcement actions against three DeFi companies. The CFTC alleged that the three firms in question allowed US users to trade crypto derivatives without acquiring the necessary registration.

Runa Updates

- During September the Runa team attended both Blockworks’ Permissionless conference and Centrifuge’s Real World Asset Summit. Here are some of our main takeaways from Centrifuge’s event.

- Stablecoins are the first RWA with mainstream adoption – more than $100B in value tokenized.

- The value add of tokenization is efficiency and transparency.

- Obstacles preventing adoption are regulation and the need for identity on chain while meeting the privacy needs of asset owners.

Questions? Thoughts? Feedback? Send us an email! info@runadigitalassets.com