This blog post recaps Runa’s TL;DRs in November and is meant to cover the most interesting token performers, crypto data, and news from the month.

FYI: Runa’s weekly TL;DRs are posted to our LinkedIn account at the end of every week. Follow us on LinkedIn here to get our weekly TL;DRs on your newsfeed.

Crypto Market Performance

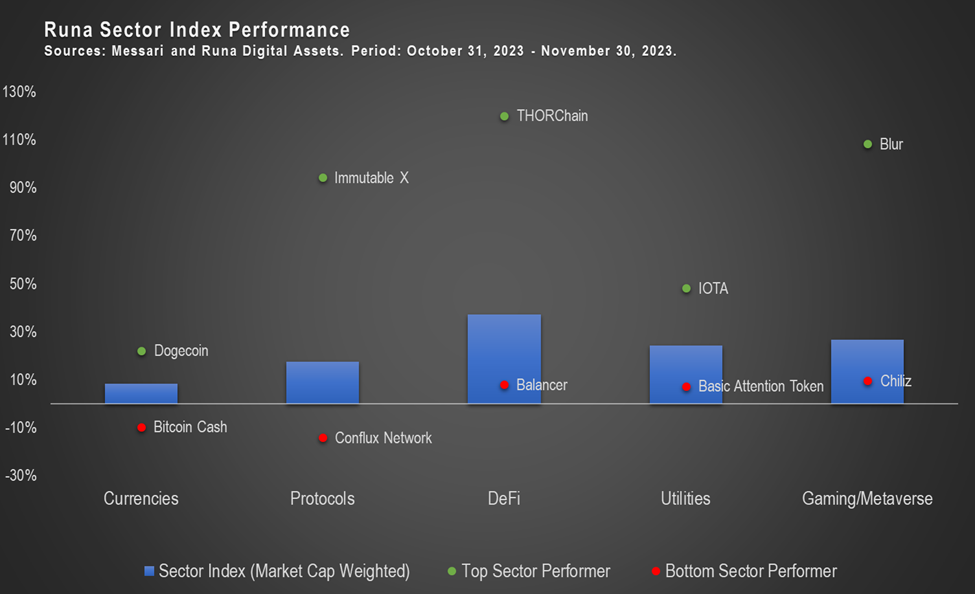

Digital asset sectors were up across the board in November. The DeFi sector led the way, posting a +37% return for the month.

From a macro perspective, the US Federal Reserve kept rates unchanged at 5.25-5.50%, as expected, and there was a weaker-than-expected US CPI print that led to expectations that this rate hike cycle is ending. From a crypto-specific perspective, we saw lots of activity, which was mostly positive.

Notable Token Performers

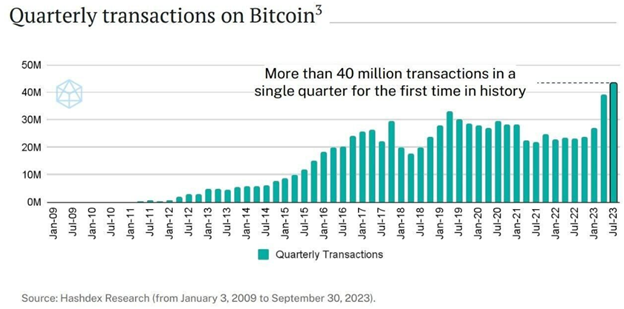

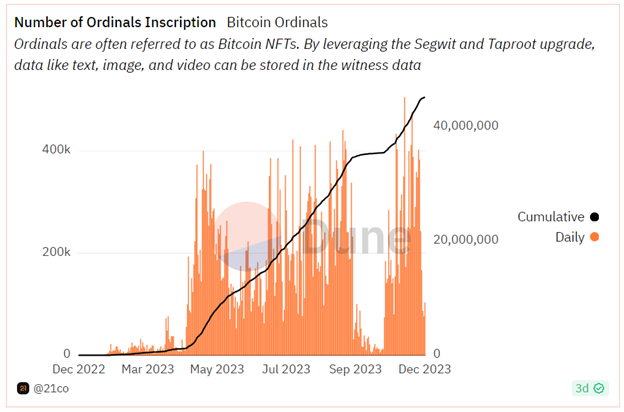

- Bitcoin (+9%): The largest digital asset continued to accelerate in November, pushed forward by anticipation around a spot ETF approval and the next halving event. Additionally, everyone, including the SEC, agrees that bitcoin is not a security and so the asset is relatively shielded from regulatory risk. On-chain fundamentals look strong as well. In Q3, Bitcoin settled more than 40M transactions, the most in a single quarter since its inception. Ordinals minting moved higher after taking a pause in September and October.

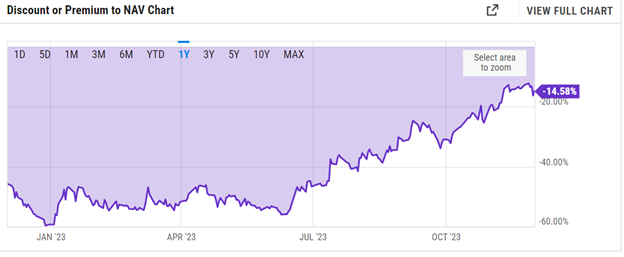

Ethereum (+13%): The second largest digital asset also benefited from spot ETF excitement. Blackrock filed for a spot ETH ETF, which lifted ETH and narrowed the ETHE (Grayscale’s closed-end Ethereum trust) discount to ~15% after trading as wide as ~60% over the past year. On-chain metrics look solid for Ethereum as well. For example, ETH’s supply has been deflationary recently.

- Solana (+54%): Solana continued its outperformance (+54% versus Protocols sector +17%). Excitement around announcements at the Solana Breakpoint conference likely contributed to the token’s extended rally. For example, Solana announced their data would be made available through Google’s BigQuery service, a resource that allows anyone to access on-chain data and analytical insights.

- Celestia (+180%): Celestia’s mainnet went live, and they airdropped 60M TIA tokens to active users on Ethereum layer 2s as well as Cosmos and Osmosis stakers, which helped boost Osmosis to end the month +92%.

- Yearn Finance (+45%): Yearn is the largest yield aggregator protocol by TVL (~$340M) and saw a spike in its token price mid-month driven by excitement around its new “vote escrow” token model. In this model, holders of Yearn’s token, YFI, can (i) lock up their tokens to receive rewards, which come in the form of protocol revenues as opposed to token inflation, and (ii) vote on yield strategies. The token gave some of that performance back toward the end of the month as the market speculated that the recent run-up was an exit scam by the project’s insiders. TVL has not followed the recent appreciation in its token price.

Notable News and Themes

- Argentina: Argentina has elected Austrian economist Javier Milei as its new President. According to The Economist, Argentina’s inflation rate currently exceeds 140%, and 40% of the population lives in poverty. President-elect Milei has promised to abolish the central bank and potentially to “dollarize” its economy as part of a series of dramatic reforms. Milei has expressed an appreciation for Bitcoin in the past and has said it represents “…the return of money to its original creator: the private sector.” We will be watching with great interest to see if Bitcoin and other digital assets play a part in Milei’s plans for an Argentine revival.

- Regulation: Binance settled with the US government and agreed to pay over $4B in fines + their CEO, CZ Zhao, stepped down and pleaded guilty to various charges. Additionally, the SEC filed another lawsuit against yet another crypto exchange: Kraken.

- FTX: FTX Founder and CEO, Sam Bankman-Fried, was found guilty of defrauding the exchange’s customers after a monthslong trial. As we stated in our Q3 webinar, the conclusion of this saga will be at least somewhat cathartic, and the industry can move on from here.

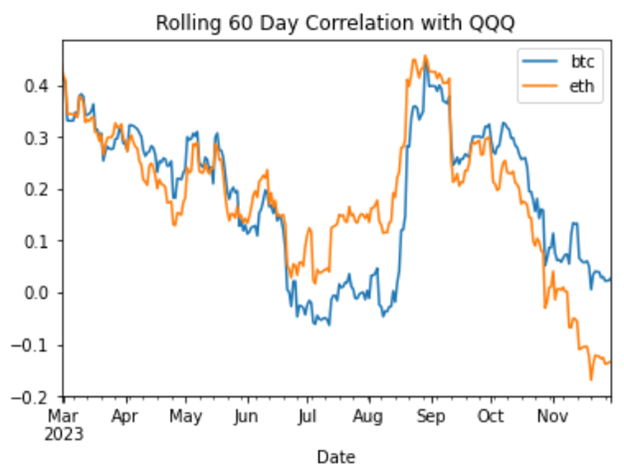

- Correlations: BTC and ETH’s correlation with traditional markets has been declining all year, despite a spike in late summer. More recently we’ve seen a divergence between BTC and ETH in regard to their correlations with the NASDAQ: ETH’s correlation is falling faster than BTC’s and is now in negative territory.

- PayPal: PayPal received a subpoena from the SEC, requesting more information on their PYUSD stablecoin on the Ethereum blockchain. We expect stablecoins will continue to grow and innovate, while also being a focus of regulators.

- Aragon: Aragon, a DAO resource project, is dissolving their association, and their ANT tokens can be redeemed for ETH until November 2024. The details of the dissolution were acrimoniously disputed. For example, the project will take any unclaimed ANT tokens for themselves at the end of the redemption period. Runa analyst, Ned, wrote about issues with DAO governance, including the Aragon situation, in his Blockworks piece, Crypto Needs to Grow Up.

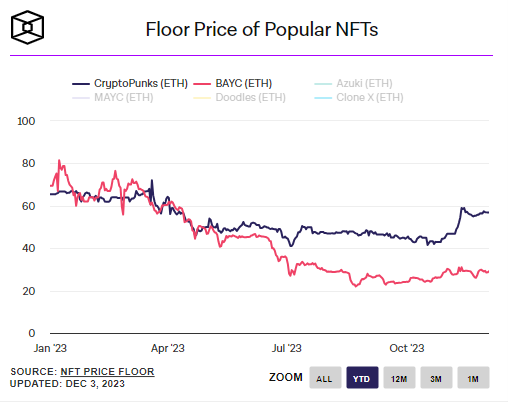

- NFTs: Prices for some of the top collections are rebounding for the first time this year.

Runa Updates

- Jennifer was on the Coinbase Institutional markets call on Bitcoin Whitepaper Day (same day as Halloween), discussing GameFi, network theory, and more. Check it out here. She also appeared on their Thanksgiving episode, featured alongside other digital asset managers. Her section starts at 7:05 here.

Questions? Thoughts? Feedback? Send us an email! info@runadigitalassets.com