This blog post recaps Runa’s TL;DRs in June and is meant to cover the most interesting token performers, crypto data, and news from the month.

FYI: Runa’s weekly TL;DRs are posted to our LinkedIn account at the end of every week. Follow us on LinkedIn here to get our weekly TL;DRs on your newsfeed.

Crypto Performance

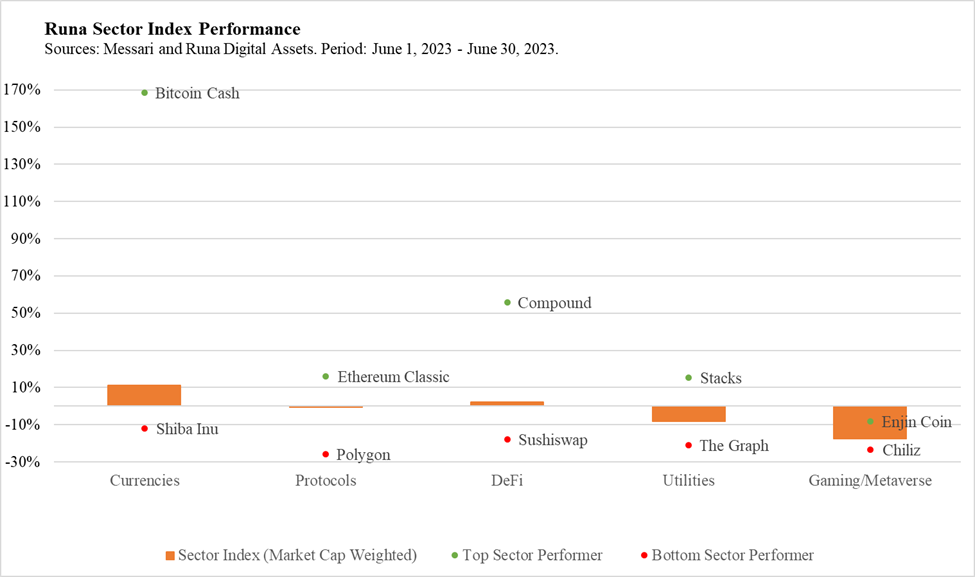

Runa’s sector indices experienced notable dispersion for the month of June. Two sectors were up, two were down, and one was flat. Additionally, the best performer (Currencies) exceeded +10%, and on the negative side, the worst sector (Gaming/Metaverse) returned less than -10%.

The story of the month was traditional finance giant BlackRock taking another step into the crypto market by filing for a Bitcoin spot ETF. BlackRock has been running a private Bitcoin trust since last year, but this is their first digital asset product which will be available to the public. Other asset managers, including Invesco, WisdomTree, and Valkyrie, piled on by also filing for Bitcoin spot ETFs.

It remains to be seen whether or not these firms will succeed where others have failed in the past in convincing the SEC to allow such a product to be offered to retail investors. Later in the month, The Wall Street Journal reported that the SEC had decided the recent group of Bitcoin spot ETF filings were inadequate. Digital asset markets sold off on this news; however, it could be a positive sign that the SEC is willing to enter into constructive conversations with the firms filing as opposed to outright rejecting their applications. Many firms quickly addressed the SEC’s concerns around trade surveillance and refiled.

This positive ETF-related news flow helped the digital asset majors end in the black despite the meaningful regulatory developments early in the month that weighed on markets. The SEC brought the proverbial hammer down onto US crypto exchanges, Binance US and Coinbase. Gary Gensler and the SEC claimed that both are operating unregistered securities exchanges and classified multiple crypto assets as securities in the process.

In response, Binance US first delisted many trading pairs from their US exchange and then announced they paused deposits from coming into the platform altogether.

Conversely, it seems to be Coinbase’s intention to take these allegations to court and to fight for regulatory clarity for the crypto industry in the US. The SEC’s suit against Coinbase coincided with 10 state regulators filing actions against Coinbase, providing further evidence that regulators are attempting to put a “full court press” on Coinbase and other crypto market participants.

In a separate, prior action, Coinbase had petitioned the SEC to create new rules for digital assets. The SEC responded to this petition in June, but refused to provide any meaningful clarity. Instead, the commission said they may be willing to provide some guidance in a few months’ time. As the legal battle between Coinbase and the SEC seems increasingly inevitable, it is clear that the SEC will fight it on their own time and not Coinbase’s.

Notable Token Performers

- Bitcoin layer 2 protocol, Stacks (+15%), and Bitcoin Cash (+168%) were the top performers in their sectors, as investors looked for possible secondary beneficiaries of Bitcoin’s strong narratives. Bitcoin Cash was also propelled by EDX Markets, a newly launched crypto exchange started by Schwab, Citadel Securities, and Fidelity, that is offering the asset, along with 3 others.

- Compound (+56%) booked a massive return, as it became the subject of speculation from retail investors in Asian markets late in the month. The founder of Compound, Robert Leshner, also announced late in the month that he was starting a new company called Superstate that aims to create regulated financial products that bridge traditional markets and blockchain ecosystems.

Notable Data

- The below chart released by K33 Research shows how the market dominance of Bitcoin, Ethereum, and stablecoins has continued to grow over the past months, now approaching 80% of total crypto market cap. This trend represents a flight to quality by crypto investors as they choose blue chip assets over alt coins.

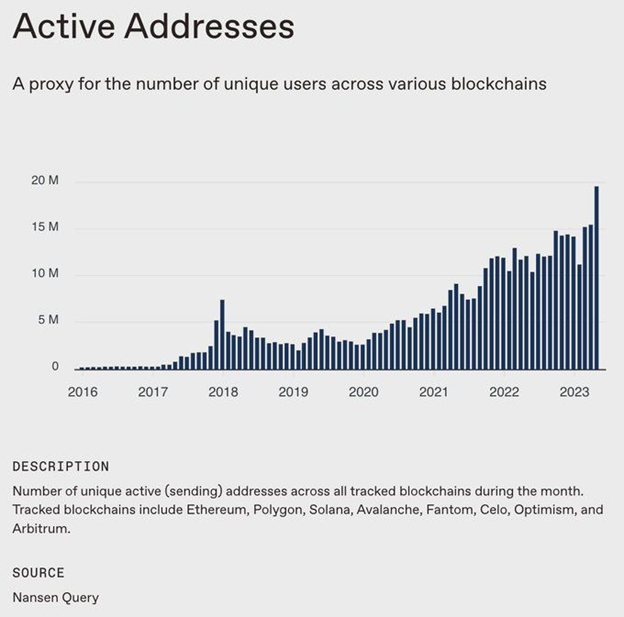

- a16z released new data on the “State of Crypto.” Within this dataset, the below chart shows how active addresses across multiple blockchains have continued to grow through the crypto bear market, reaching all-time highs last month.

- The chart below from Steakhouse Financial shows the tremendous growth of tokenized securities, including ETFs, stocks, and T-Bills, on Ethereum this year, reaching $264M in the final week of June.

Notable News

- Nike’s digital collectibles arm .Swoosh announced that their assets would be integrated into EA Sports video games. Allowing holders to show off their Nike digital collectibles within popular gaming titles is an exciting development for NFTs at large and reaffirms Nike’s commitment to bringing their brand into Web3.

- Worldwide payment network Swift announced their plans to experiment with using blockchain payment rails to transfer tokenized value across multiple private and public blockchains. More than a dozen financial institutions will participate in this program as blockchain tech continues to make inroads in the traditional financial system.

Runa Updates

- Content: Check out this Arbor Digital podcast where Marc Nichols interviews Runa’s CEO and Founder, Jennifer Murphy. They discuss, among other topics:

- How the early years of Jennifer’s career in investment management formed her views on valuation

- The stages of technological revolutions

- The importance of studying networks for the professional digital asset investor

- Events: Jennifer was on Capitol Hill in June, attending an Investment Adviser Association Advocacy Day. While there Jennifer and others got to meet with lawmakers to discuss issues relevant to investment management, a timely opportunity given the month’s regulatory developments.

Questions? Thoughts? Feedback? Shoot us an email! info@runadigitalassets.com