This blog post recaps Runa’s TL;DRs in July and is meant to cover the most interesting token performers, crypto data, and news from the month.

FYI: Runa’s weekly TL;DRs are posted to our LinkedIn account at the end of every week. Follow us on LinkedIn here to get our weekly TL;DRs on your newsfeed.

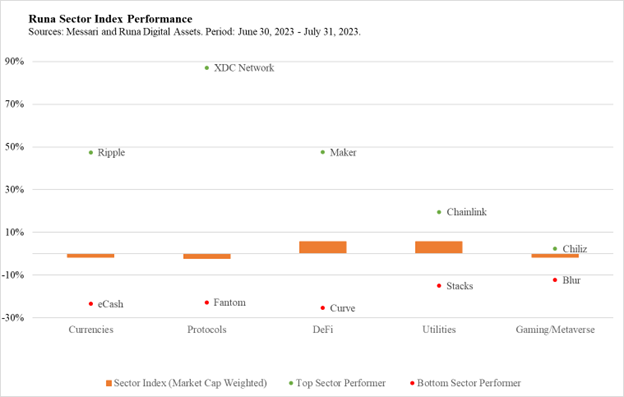

Crypto Performance

Digital asset markets continue to experience dispersion in performance at both the sector and token level. July saw a similar trend to June, two of Runa’s sector indices were positive, the other three posted losses for the month. Ripple (+47%) benefitted from a favorable regulatory ruling. Maker (+48%) and Chainlink (+20%) are driving the resurgence of DeFi 1.0.

Regulatory news once again was a dominating force in digital asset markets during July. In June, the SEC alleged both Coinbase and Binance were operating unregistered securities exchanges and classified multiple crypto assets as securities in the process. The Blackrock ETF filing was a surprising move in light of the SEC’s stance and provided support for digital asset markets.

July brought additional regulatory support to digital asset markets and for altcoins more specifically. The District Court in the Southern District of New York made a summary judgment in the SEC’s case against Ripple Labs regarding its XRP token and transactions that may be unregistered sales of securities. The court found the XRP token itself is not a security, and XRP sales on secondary exchanges did not violate securities laws. However, they did rule XRP sales in certain private transactions were unregistered securities offerings.

Crypto market participants viewed the ruling as a regulatory win for digital asset tokens and exchanges. XRP (+47%) soared on the news as did other altcoins named in the SEC lawsuits from June. XRP was immediately relisted by digital asset exchanges who had formerly delisted the token. Coinbase’s stock ($COIN) rallied 38% in July on the back of the ruling.

Notable Token Performers

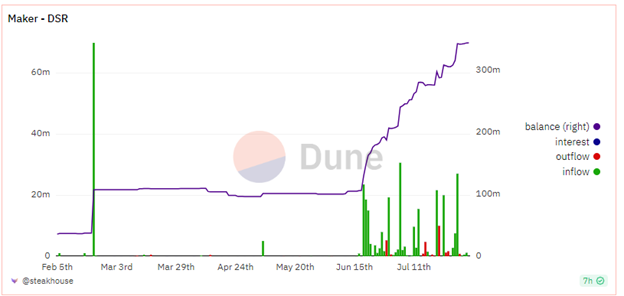

- Maker (+48%) led the DeFi sector (+6%) higher in July with the announcement of an increase in the DAI Savings Rate (DSR) module. Maker increased the yield paid to DSR depositors to 3.49% from 1%, leading to over $100M in inflows. The deposit increase has also led to an increase in revenue and earnings for Maker. Maker’s current P/E ratio is 9x.

Source: Dune Analytics

Source: Dune Analytics

- Chainlink (+20%) announced the launch of their Cross-Chain Interoperability Protocol (CCIP). The feature allows for developers to build applications and services that can transfer tokens and messages across many different blockchains. We are amidst “L2 Summer,” and new blockchains are launching weekly, making interoperability all the more necessary. For applications, deploying and integrating across blockchains will offer the best user experience. CCIP will be integrated with Ethereum, Optimism, Polygon, Abitrum, and Avalanche. Leading DeFi apps Synthetix and Aave have already announced plans to integrate with CCIP.

- Curve (-25%), the leading stableswap DEX, suffered a hack of ~$60M on July 31st. A bug was found in an old version of Vyper, a programming language, causing a security failure. Curve saw $1B of TVL outflows after the hack.

Notable Data

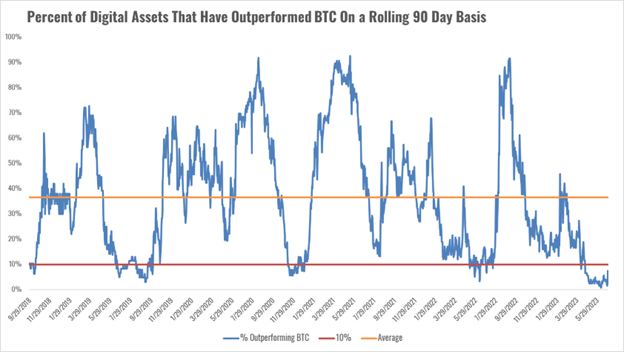

- Wen Alt Season? Bitcoin dominance has been on a steady incline throughout the first two quarters of 2023. The below chart shows the percentage of digital assets outperforming Bitcoin over a rolling 90 day period. It reached a new low in 2023.

Sources: Runa Digital Assets, CoinMarketCap, VanEck

Sources: Runa Digital Assets, CoinMarketCap, VanEck

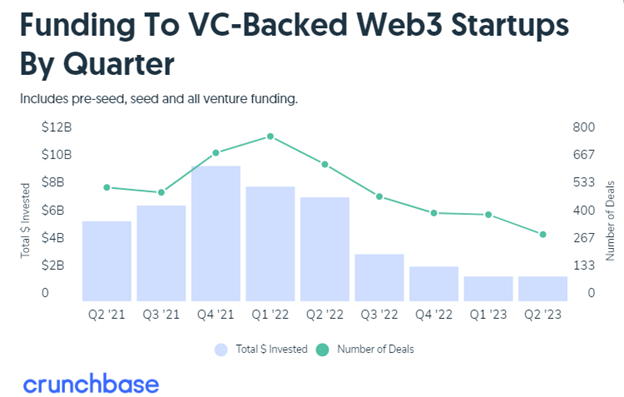

- Venture funding has slowed in all industries, but Web3 and crypto are among the hardest hit. VC funding was just $1.8B in Q2, a 76% decline from the same period last year.

Source: Crunchbase

Notable News

- Worldcoin, a blockchain project started by OpenAI founder Sam Altman, launched the $WLD token in July. The project seeks to generate a “World ID” that is a “privacy-preserving digital identity designed to prove an individual’s unique personhood.” To generate your ID, you must scan your eyeballs into an “Orb” to verify your identity. Worldcoin believes digital identity will be needed in the age of AI to differentiate humans from bots.

- Blackrock CEO Larry Fink appeared on both Fox Business and CNBC to discuss Blackrock’s Bitcoin ETF filing and the firm’s efforts in crypto. Fink said Blackrock is “working with regulators” and receiving more questions about crypto from their global investor base. On crypto: “That’s why we believe there’s great opportunities and that’s why we’re seeing more and more interest. And the interest is broad-based worldwide.”

Runa Updates

- Runa’s Alex Botte and Max Williams appeared on FalconX’s inaugural Client Roundtable to discuss digital asset markets with the Bitwise Investments team. See the replay here.

- Runa published an article in Coindesk’s “Crypto for Advisors” series. The article “Unblocking Crypto” highlights various methods to gain investment exposure to digital assets.

- The Runa team held our Q2 webinar to discuss market events, regulation, and the intersection of crypto and AI. Please reach out to us for a replay link.

Questions? Thoughts? Feedback? Shoot us an email! info@runadigitalassets.com