This blog post recaps Runa’s TL;DRs in January.

FYI: Runa’s weekly TL;DRs are posted to our LinkedIn account at the end of every week. Follow us on LinkedIn here to get our weekly TL;DRs on your newsfeed.

Crypto Performance:

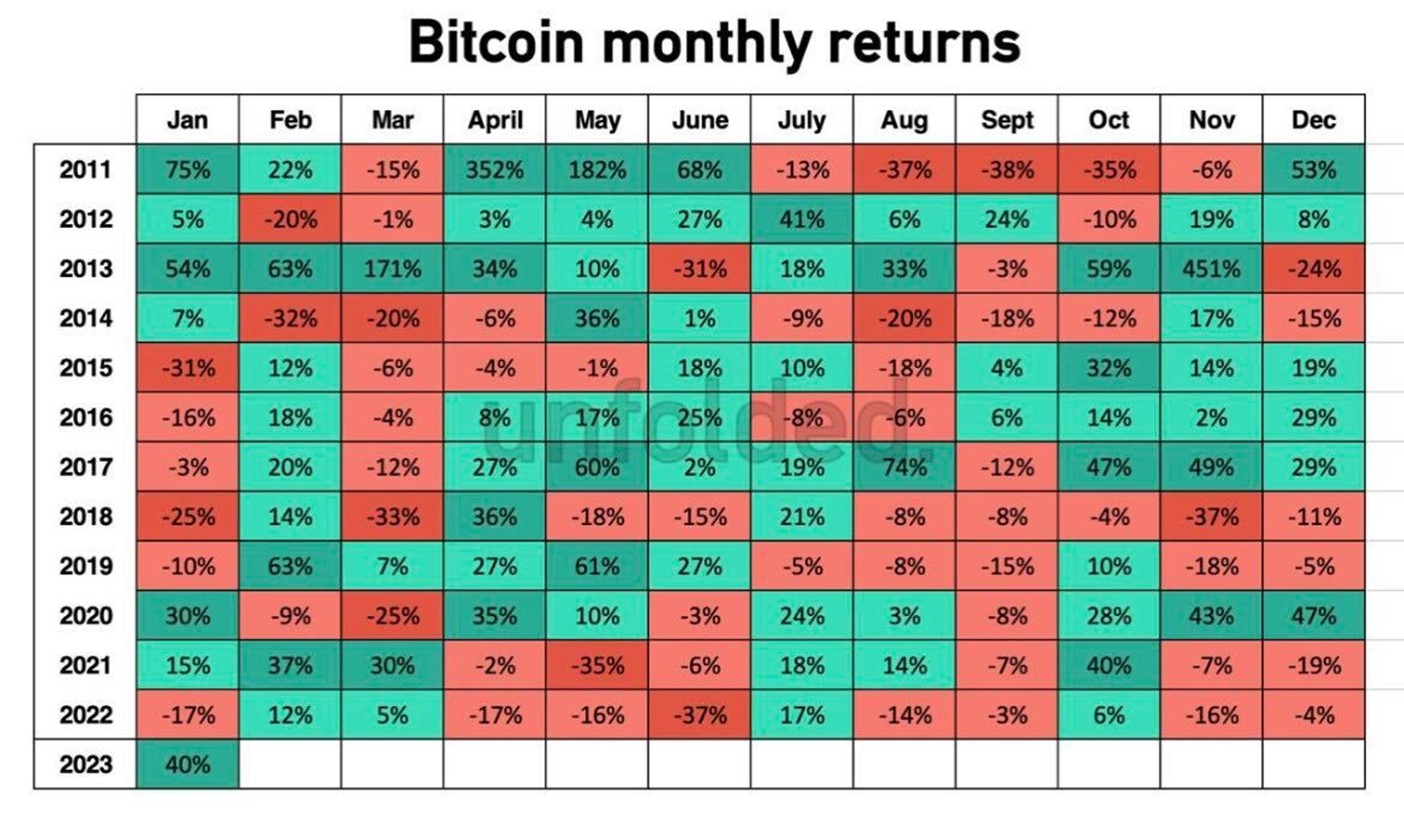

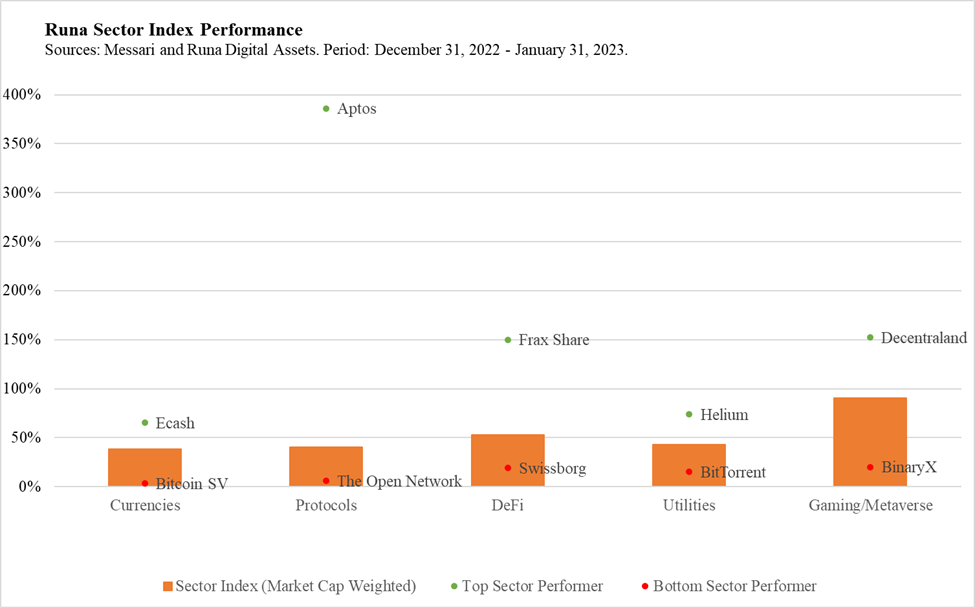

- Runa’s sector indices, which are built using liquid tokens and are market-cap weighted, were all positive for the month. Bitcoin posted its best January since 2013 and its best month since October 2021 with 40% gains. Alt coins, especially those that were high beta and lower quality (in terms of fundamentals), outperformed. Gaming/Metaverse was the best performing sector with 90% returns.

- The standout performer was Aptos (+386%), a relatively new layer 1 blockchain that aims to compete with Ethereum (+33%), Solana (+140%), and others. Aptos is a highly inflationary token with less than 20% of its total token supply currently circulating. The market embraced other inflationary tokens as well like Optimism (+136%) and dYdX. The latter was additionally boosted by an announcement toward the end of the month that they would delay a major token unlock.

- The top performer in the DeFi sector was Frax Share (+150%). Frax began as an algorithmic stablecoin protocol but has since expanded its offerings to include a borrow/lend feature and most recently Ethereum liquid staking. Users who stake their Ethereum through Frax are eligible to receive higher yields than those on offer from competitors such as Lido (+131%) and Rocket Pool, prompting investors to speculate that Frax may be able to capture some liquid staking market share from these more established competitors.

- Speaking of Lido, it is now the largest DeFi protocol in terms of total value locked (a DeFi metric that aggregates the dollar value of assets held within protocols).

Notable Data:

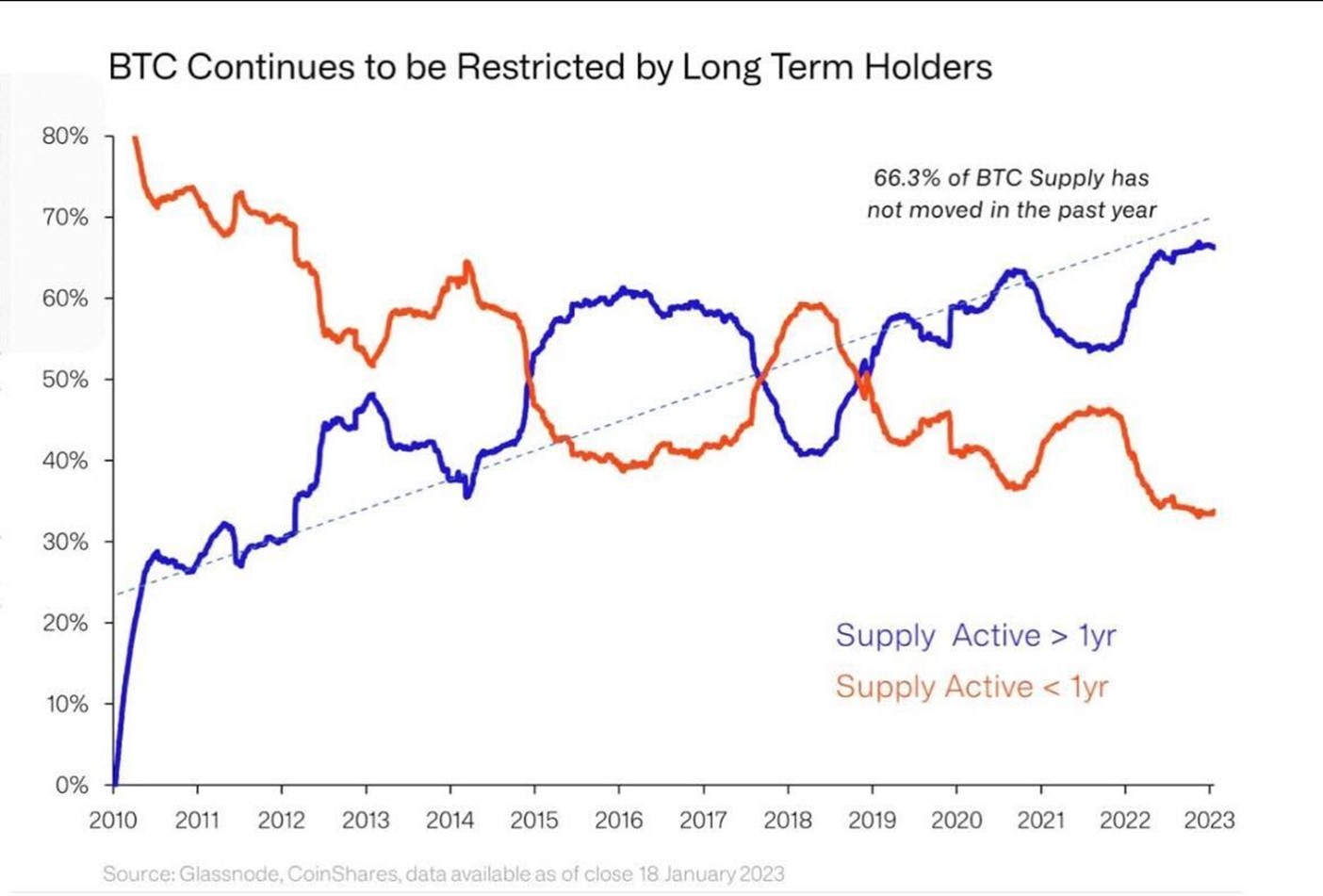

- Two thirds of the available BTC supply has not moved in a year. The percentage of long-term holders, who seem unaffected by the strong start to the year for BTC, has been moving “up and to the right,” while the percentage of short-term, perhaps more speculative investors, has declined.

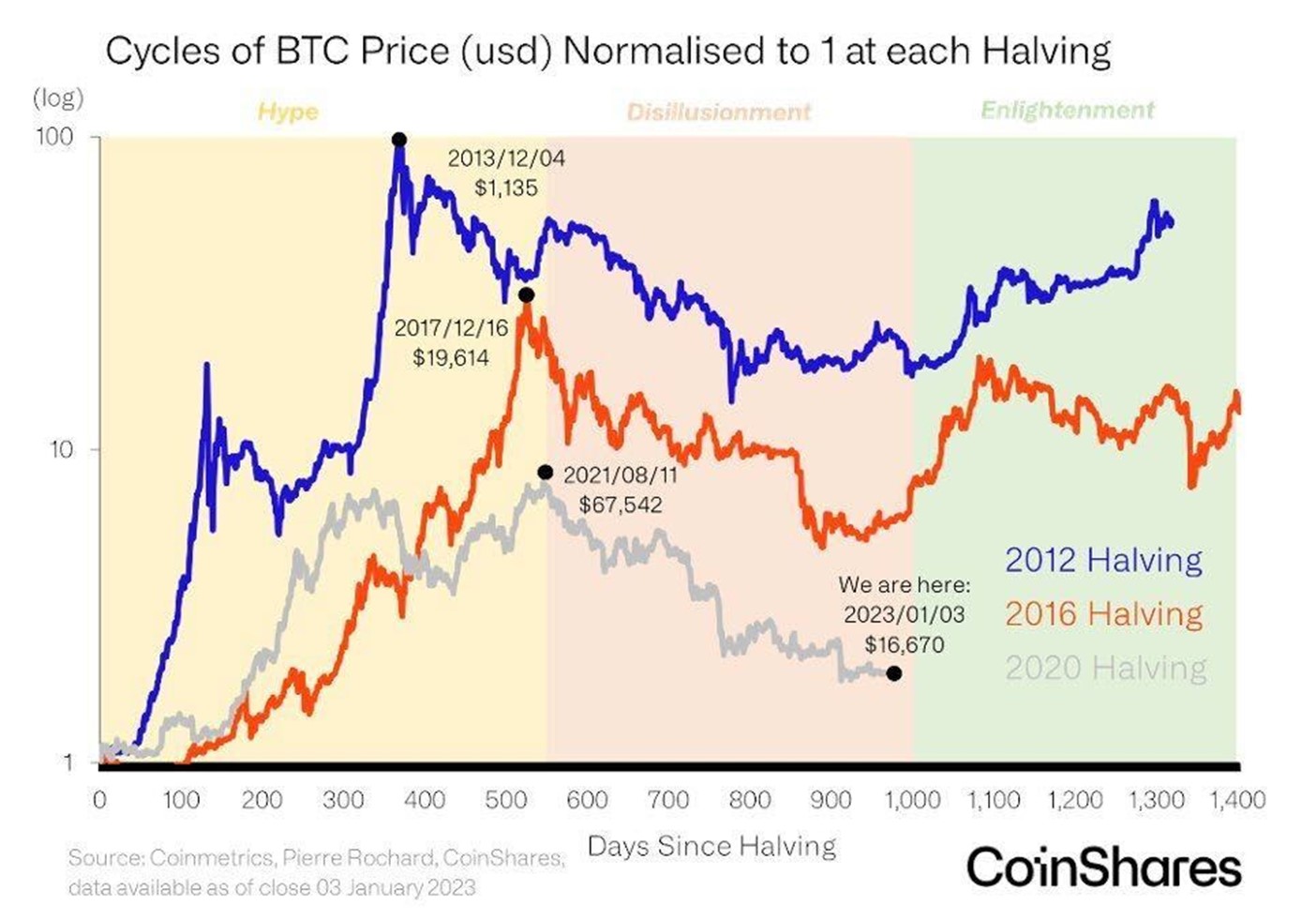

- Crypto research firm CoinShares released the following graph showing Bitcoin’s historic performance leading up to halving events (Bitcoin halvings occur approximately every four years at which time the number of Bitcoin that is created every block is cut in half). The data here suggests that we are now entering the “enlightenment” phase, wherein investors begin to look forward to the next halving as a positive event, driving Bitcoin price upward. The next Bitcoin halving is projected to occur around April 2024.

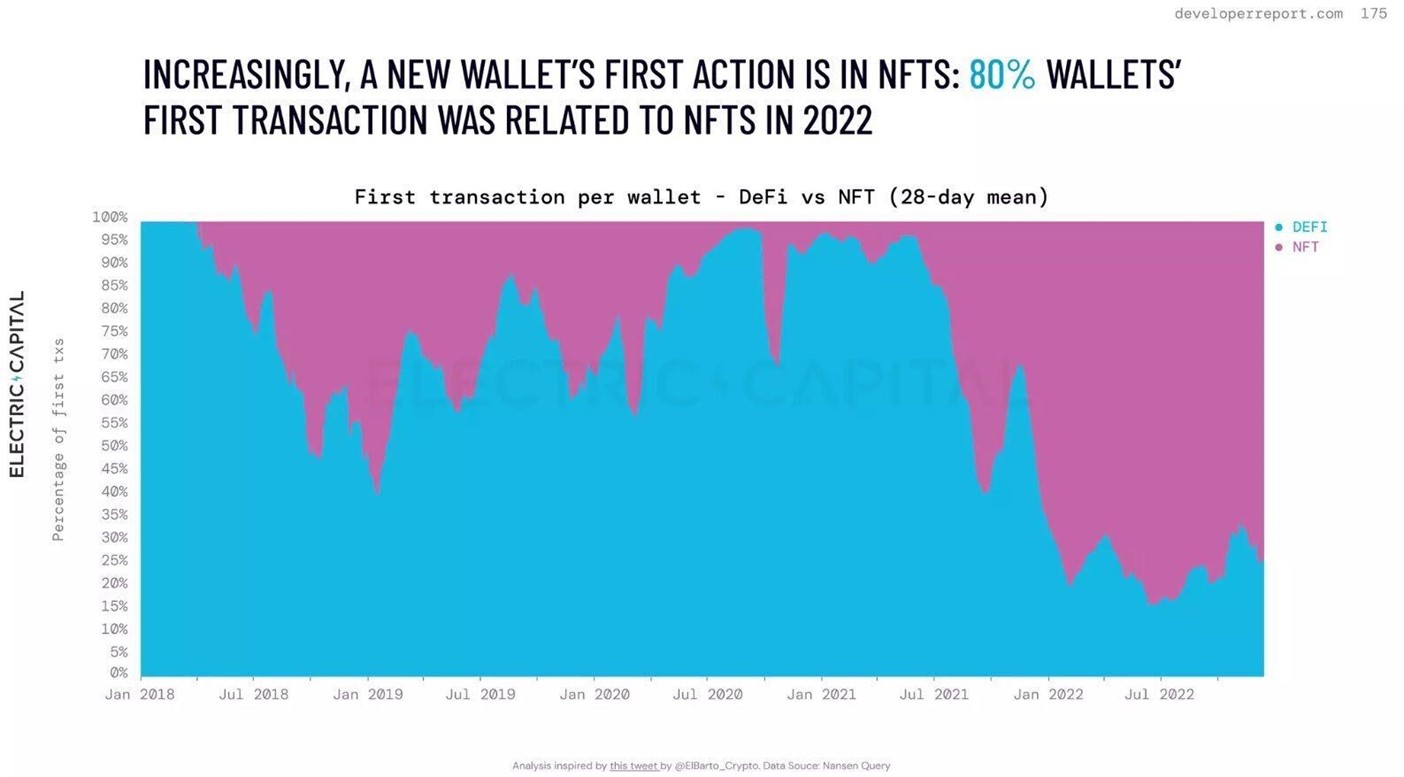

- Digital asset investment firm Electric Capital released their 2022 Developer Report. This report is full of high-quality information, but one data point that jumped out at us was that in 2022 80% of wallets’ first transactions were NFT related. This shows how, despite a decline in NFT prices and trading activity in 2022, these assets still are very attractive to retail users and continue to bring new individuals into Web3. We encourage you to read the report in its entirety here: https://lnkd.in/dWNHf4KM

Notable News:

- Silvergate Bank, which has become a favorite bank for crypto companies, disclosed they had faced withdrawals of $8.1B in deposits, representing a 70% drawdown. This disclosure led to significant concerns from investors, causing Silvergate stock to decline early in the month.

- After the FTX collapse in November last year, Genesis (a centralized crypto lender) paused withdrawals, which impacted another centralized crypto company called Gemini, which used Genesis to generate yield on customer assets in their Earn program. The Winklevoss twins, Gemini’s founders, put pressure on Barry Silbert, CEO of Digital Currency Group (owner of Genesis) to find a solution for Genesis customers. Silbert released a publicly facing letter to shareholders and an FAQ describing the state of affairs at Genesis and DCG’s involvement. On top of all that, the SEC announced a lawsuit against both firms for allegedly selling unregistered securities. Later in the month, Genesis filed for bankruptcy.

- DCG letter and FAQ: https://dcgupdate.com/

- SEC press release: https://lnkd.in/gdCMpe7Z

- The crypto winter has continued to affect large centralized crypto exchanges, with Coinbase and Crypto.com announcing more staff layoffs this month.

- The U.S. Department of Justice announced new enforcement action being taken against Hong Kong crypto exchange Bitzlato. US authorities alleged that the exchange had been a haven for illicit transactions, with their estimates stating Bitzlato processed $700M in illicit funds. You can read more from Reuters here: https://lnkd.in/egu9V5YW

- Moody’s, who provides credit ratings for publicly traded companies, announced they are planning to rate up to 20 stablecoins based on the quality of their reserve attestations. A scoring system by a leading credit research and ratings firm on the traditional finance side could help accelerate the institutionalization and broad market adoption of stablecoins.

Runa Updates:

- Content:

- Runa released our end of year report that summarizes our thoughts about market events from 2022 and explains our outlook going into the new year. Read it here: https://www.runadigitalassets.com/runa-digital-assets-2022-sector-review/

- Past events:

- Runa’s COO, Max Williams, and Head of Client and Portfolio Solutions, Alex Botte, attended the iConnections Global Alts conference at the end of January where we were able to connect with allocators, technology partners, and others in the digital asset industry.

- Upcoming events:

- Runa’s CEO, Jennifer Murphy, will be a panelist on an FDP/CAIA webinar in late February discussing DeFi and digital disruption. She will be joined by other women with long careers in traditional investment management. More details soon.

- Jennifer will be sharing her expertise at the upcoming Hedge Fund US Digital Assets Summit on Thursday, March 2nd in New York. Learn more about the event and register your place via the link here: https://lnkd.in/eSdWDz3h Please note: registration for this event is open to GPs and LPs only.

- Jennifer will be a panelist at AIMA’s Digital Asset Forum in New York.

Questions? Thoughts? Feedback? Shoot us an email! info@runadigitalassets.com

#bitcoin #ethereum #crypto #digitalassets #marketrecap #investmentmanagement #aptos #liquidstaking #electriccapital #alternatives #silvergatebank #genesis