This blog post recaps Runa’s TL;DRs in August and is meant to cover the most interesting token performers, crypto data, and news from the month.

FYI: Runa’s weekly TL;DRs are posted to our LinkedIn account at the end of every week. Follow us on LinkedIn here to get our weekly TL;DRs on your newsfeed.

Crypto Market Performance

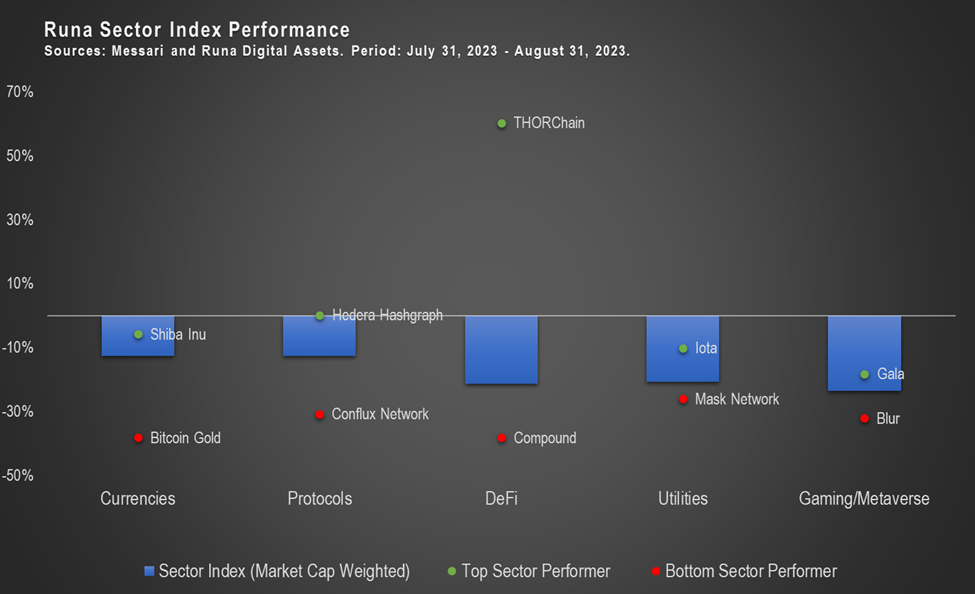

Digital asset sectors were down double digits across the board in August.

We’ve been in a strange low liquidity environment paired with historically low volatility. You’d perhaps expect low liquidity to result in higher volatility (price discovery is difficult when there is low liquidity, trades have more potential to move the market, etc.), but that’s not what we’ve seen. Market activity in mid-August bucked that trend. BTC fell 7% on August 17th, and the motive was unclear. It happened around the time Chinese property giant, Evergrande, filed for bankruptcy and news of SpaceX writing down their BTC holdings broke. No doubt there was still a good amount of leverage in the system, and liquidations made the downward move more pronounced. Liquidity remained dry as traders tried to sell or adjust their portfolios. Bloomberg’s reports of the SEC likely approving an ETH futures ETF (more on that below) helped backstop the selling, but that wasn’t anywhere near enough to return to the prices seen earlier that day.

After that event, the market returned to its longer-term trend of low volatility. We don’t believe the market’s lower valuations in August reflect the implications of another major legal win for the crypto industry and a notable step forward to getting a spot ETF approved in the US: a judge ruling on August 29th in Grayscale’s favor in their battle vs. the SEC to convert Grayscale’s Bitcoin Trust (GBTC) to a spot BTC ETF. Grayscale’s huge legal win paves the way for mainstream adoption of Bitcoin and digital assets. Runa’s CEO and Founder, Jennifer Murphy, shares our views in this letter.

Notable Token Performers

- Curve (-20%): A hacker exploited a coding language used by some of Curve’s pools and stole ~$60M early in the month. The CRV token fell dramatically, spilling over into other areas of DeFi. Curve’s founder had loans backed by CRV on other DeFi protocols, Frax Finance (0%) and Aave (-15%), which were at risk of being liquidated. The hacker eventually began returning assets after Curve offered a 10% bounty.

- Hedera Hashgraph (0%): Hedera Hashgraph made headlines with (1) a network upgrade and (2) a micropayments platform added to the FedNow Services providers list.

- THORChain (+60%): THORChain shipped an innovative lending feature, enabling no-interest, no-liquidation, and no-expiration loans for borrowers.

- dYdX (+4%): According to Nansen, smart money traders started accumulating the token in advance of the protocol’s app-chain launch on Cosmos.

Notable News and Themes

- Base: Coinbase’s layer 2 blockchain, Base, built on top of Ethereum, opened to the public this month. TVL climbed on the network (it now sits at ~$380M according to DeFi Llama), as people bridged over to earn an NFT and begin exploring the network and its apps. A popular app that rose (and then fell) in interest over the month was Friend Tech, a social networking app.

- PayPal: PayPal announced their own stablecoin, PYUSD, which will operate on Ethereum. This is major news for a few reasons: (1) PayPal decided to run their stablecoin on a public blockchain instead of their own private network, (2) PayPal, with ~430 million active accounts, has the potential to onboard millions to crypto and have users experience firsthand the benefits of a global, 24/7/365, USD-based digital currency, and (3) other fintechs will follow – this move is beneficial to PayPal because it allows them to capture more payment activity (both sides of a transaction don’t need a PayPal account, as PYUSD can be sent to any public Ethereum address).

- Stablecoins:

- The Federal Reserve outlined a path for state banks to issue, hold, and transact in stablecoins. The Fed also said it is creating a new supervisory program to strengthen their oversight of bank activities related to crypto and blockchain.

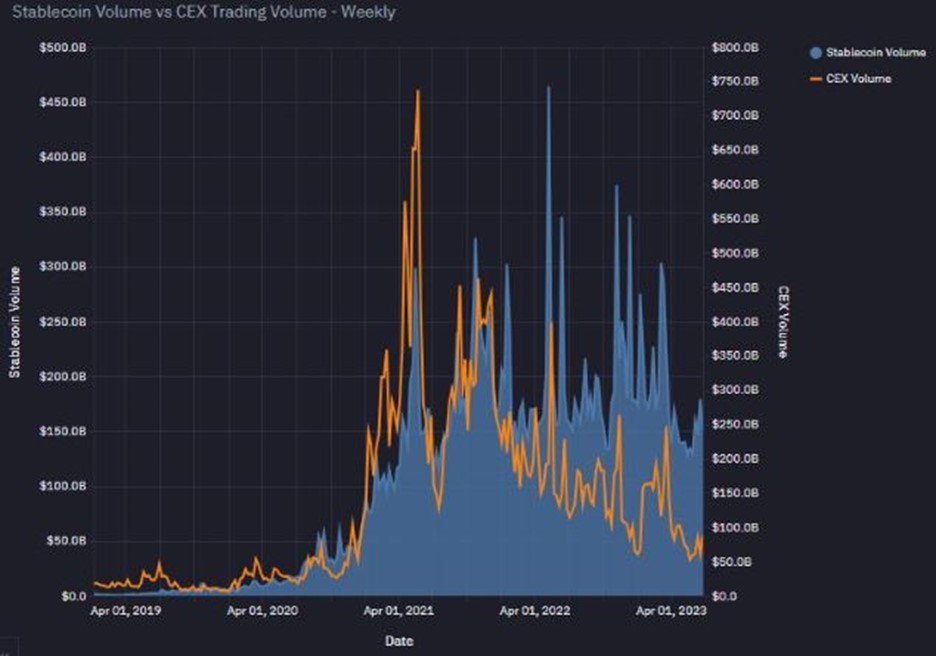

- A Brevan Howard Digital report showed that stablecoin volumes have decoupled from speculative activity. While CEX volumes are down 64% since December 2021, stablecoin volumes are down only 11%.

-

- Solana Pay integrated with Shopify, enabling payments in stablecoin, USDC. Merchants are incentivized to use this option to avoid hefty credit card fees (1-4%) vs. $0.00025 for Solana Pay.

- Speaking of USDC, Coinbase purchased a minority stake in Circle, operator of USDC, and native USDC is launching on six new blockchains: Polygon PoS, Base, Polkadot, NEAR, Optimism, and Cosmos.

- ETH Futures ETF: This month the race for an ETH futures ETF commenced with multiple firms filing. While not spot-based, an ETH futures ETF would be the first of its kind and, if approved, the first such product could launch in mid-October.

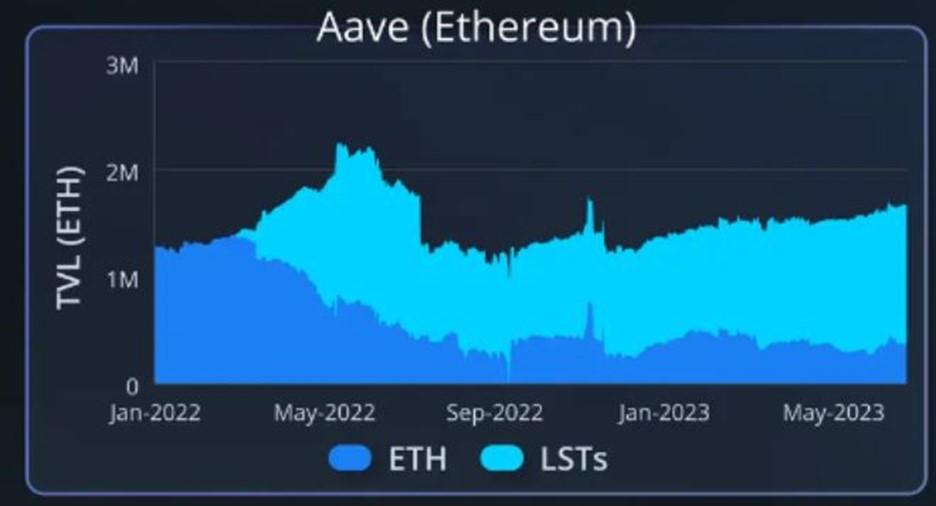

- LSDFi: The advent of liquid staking has enabled DeFi applications to leverage predictable, low-risk, and crypto-native real yield. ETH stakers are making use of LSDs’ utility, as LSDs are overtaking pure ETH as collateral assets in DeFi protocols like Aave. This emerging theme is called LSDfi (or liquid staking token finance).

Source: Messari

Runa Updates

- Crypto needs to grow up. Runa’s Ned Menton wrote an op-ed in Blockworks that lays out how Web3 projects still act like startups despite their size. Institutional capital will not accept current practices – mainstream adoption will require these projects to professionalize their practices. Read it here.

- Do fundamentals drive returns in digital asset markets? Runa’s Alex Botte explores the relationship between blockchain fundamentals (like TVL, fees, and users) and token returns. Read it here.

- Meet with the Runa team. We will be attending Permissionless (9/11-9/13) and Centrifuge’s RWA Summit (9/19). We’ll also be in SF (9/5-9/8 and 9/11) and NY (9/18-9/22) during the month. Please contact us if you’d like to meet up!

Questions? Thoughts? Feedback? Send us an email! info@runadigitalassets.com