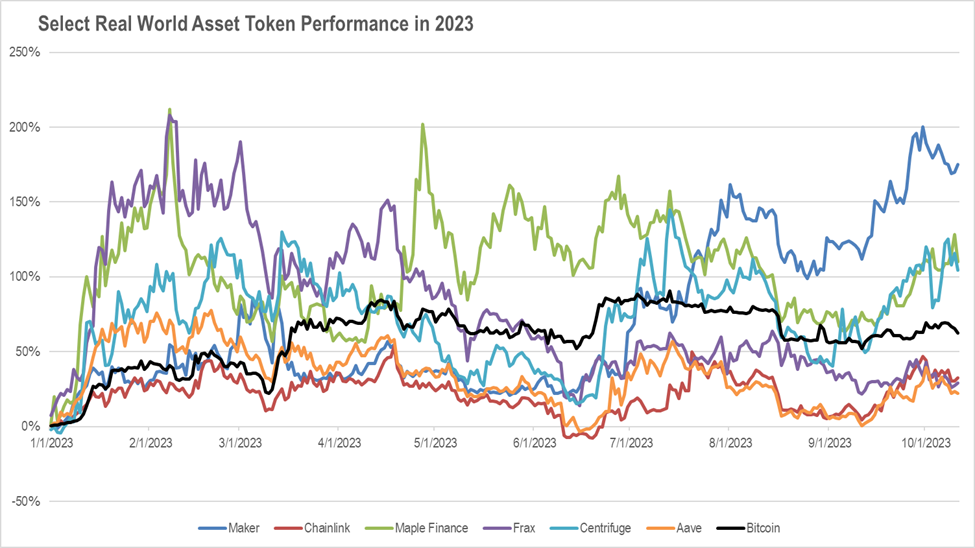

BTC has been the token to beat this year, up 63% through 10/11. Impressively, some real world asset-related tokens, such as Maker, Maple Finance, and Centrifuge, have outpaced that performance, while others, such as Chainlink, Frax, and Aave, have underperformed YTD, but have rallied recently. One difference between these two groups is that the former are “OGs” – they’ve been around for years and have had early RWA success. The latter group are relative newcomers to RWA, launching their initiatives as recently as this month in the case of Frax.

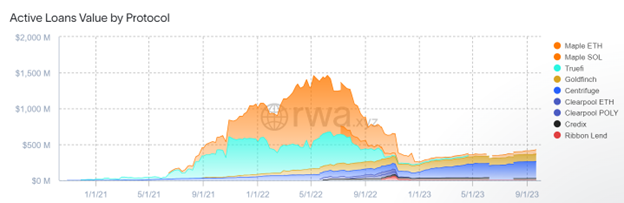

How do RWAs’ fundamentals look? According to rwa.xyz, active on-chain loans on the private credit side have been steadily rising this year, after peaking in mid-2022.

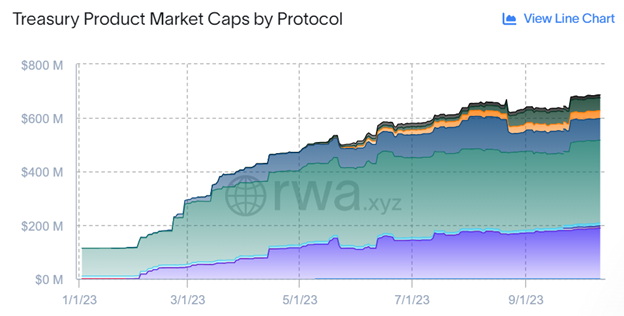

The real traction this year though has been bringing US Treasuries (USTs) on-chain, as their yields of ~5% are attractive, especially when compared to (i) falling DeFi yields and (ii) the opportunity cost of holding stablecoins, a majority of which are non yield-bearing.

The fundamental growth we’ve seen in RWAs is notable, especially when compared to the overall DeFi ecosystem, which has seen total value locked (TVL) decline by 6% from $38.5B to start the year to $36.3B today.

Max Williams and Alex Botte attended the inaugural RWA Summit in New York last month. Here were a few of the most interesting topics, some of which were contested and debated.

- Stablecoins were the “OG” RWA use case, as they brought “real world” assets like the US dollar on-chain. Stablecoins have clearly found product market fit (PMF): while they represent only ~10% of total crypto market cap ($120B stablecoins vs. $1.1T total), they increasingly make up the majority of on-chain transactions (~70%). What’s the next RWA use case? Some posited it’s other “low risk, lowly volatile” assets, pointing to the growth in on-chain USTs this year and yield-bearing stablecoins coming to market like sDAI, sFRAX, and USDY. Others believe it could be tokenized versions of private funds (e.g., Hamilton Lane and others tokenizing their funds using Securitize on Polygon), which expands the funds’ distribution, reduces their costs, and creates operational efficiencies.

- Permissioned vs. permissionless blockchains? There is a trend of institutions launching their own blockchains (e.g., Coinbase, Citi, JPM). Some say it doesn’t matter if they are building on private or public blockchains right now. It’s just important they’re flexing those muscles, hiring talent, and building the tech. In some cases, private blockchains are the “playground” institutions need to get comfortable moving away from fully private to fully public blockchains. In the middle of the spectrum, some imagined a future state where every company has their own private blockchain and they will need to communicate with other blockchains (both private and public) through bridges. Still others say “permissioned DeFi is not DeFi” and “permissioned blockchains are just databases” – the whole idea of private and permissioned blockchains defeats the purpose of building a truly decentralized financial ecosystem.

- What’s holding back RWA adoption? Several factors: an absence of public policy / clear regulatory framework in the US, high transaction fees (EIP-4844 will help by lowering layer-2 fees), better UI/UX especially around wallets, and the need for identity, credit scoring, and reputation building on-chain.

While projects related to this theme have outperformed recently, we don’t believe significant RWA adoption will happen overnight. This is likely a process that will unfold over several years.

Thanks to our friends at Centrifuge for hosting the RWA Summit and to rwa.xyz and others for providing the data and tools to understand progress in this space!