This summer Runa Digital Assets launched a weekly TL;DR series, which seeks to accomplish three things:

- Provide you with an overview of crypto market performance by sector

- Share our thoughts on what we believe are interesting crypto news and events

- Give an update on events and happenings at Runa

These are posted to Runa’s LinkedIn account at the end of every week. Follow us on LinkedIn here to get our weekly TL;DRs on your newsfeed.

This blog post recaps Runa’s TL;DRs in August.

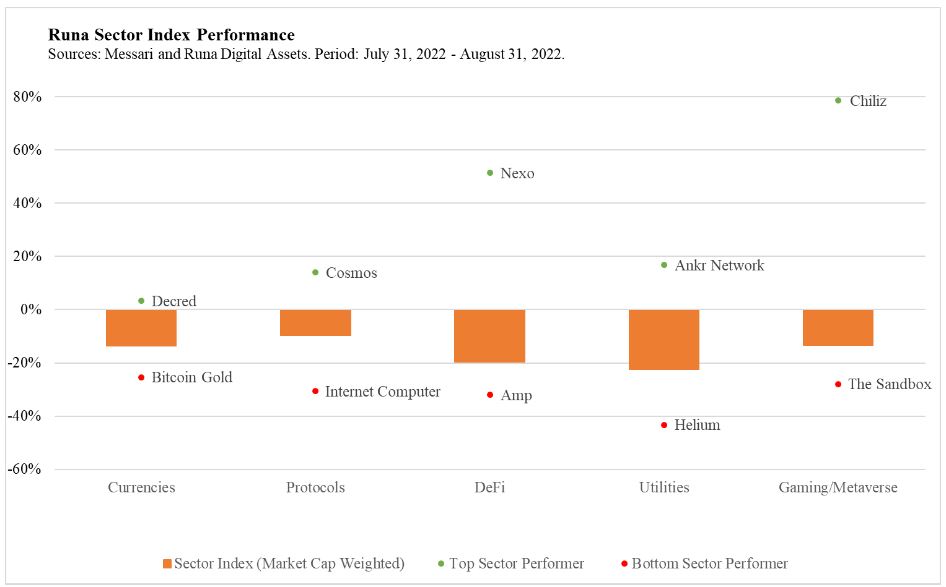

Crypto Performance: Runa’s sector indices, which are built using liquid tokens and are market-cap weighted, were all down between 10% and 23% for the month, with the Utilities sector posting the worst performance. Here are our notes on some of the top out and underperforming tokens for the month:

- Helium (-43%), a decentralized wireless network using its own blockchain, was the worst performer in Utilities. Big news for the project was a proposal to migrate Helium to the Solana (-27%) blockchain. While there are pros to this potential move (e.g., access to the Solana ecosystem), a con might be that, because this would eliminate the need for Helium stakers who currently “lock up” $HNT (Helium’s token) to participate in block production and security of the Helium blockchain, some amount of $HNT might be sent to exchanges and sold in the near-term.

- Ankr Network (+17%), a globally distributed infrastructure protocol that builds multi-chain tools used by smart contract platforms, DeFi protocols, NFT marketplaces, and more, was the top performing asset in Runa’s Utilities sector. Staking of $ANKR went live last month, allowing token holders to earn a share of all revenues coming through the Ankr Network.

- Chiliz (+79%), the native token of the Socios.com marketplace where users can purchase fan tokens from popular sporting franchises from across Europe and South America, was the month’s top performing asset across all of Runa’s sectors. These fan tokens grant their holders voting rights in team decisions, and with many European soccer leagues kicking off over the past weeks.

Notable News:

- Ethereum (-7%) scaling solution Optimism launched a liquidity mining program with DeFi protocol Aave (-13%). The program effectively incentivizes users to provide liquidity on the version of the Aave application that is built on top of Optimism. Optimism’s total value locked (TVL), a metric of the amount of assets on the protocol, soared as a result.

- BlackRock announced a partnership with Coinbase unlocking access to Bitcoin on the Aladdin platform where BlackRock’s institutional clients trade traditional assets like stocks, bonds, and fiat currencies. We view this as a tremendous step forward for traditional asset management adoption of digital assets. BlackRock then doubled down on their digital asset push by launching a spot-based bitcoin product for institutions. BlackRock said the firm has conducted work in four areas of digital assets: permissioned blockchains, stablecoins, crypto assets, and tokenization. Their research across multiple areas within crypto makes us hopeful that we can expect more digital asset related innovations and offerings from the world’s largest asset manager.

- In more news for Coinbase, they announced the launch of a liquid staking derivative token called $cbETH. Liquid staking allows a blockchain’s token holders to pledge their assets to participate in the blockchain’s validation and block production process. In return, they receive a derivative token (like an IOU) that can be used in DeFi protocols and other decentralized applications. Coinbase’s $cbETH will compete with $stETH, which is Lido’s ETH liquid staking derivative token. Lido currently has ~90% liquid staking market share. We believe that Lido’s lower fees and relative decentralization will likely allow them to remain the market leader. However, Coinbase’s $cbETH may offer an easier, more seamless onboarding experience for newcomers to liquid staking.

- As crypto prices dropped, temperatures surged in much of Texas, putting excessive stress on the state’s energy grid. Bitcoin miners have stepped in to lessen the load, voluntarily shutting down their mining rigs and freeing up 1000 megawatts to be directed to more essential uses. The state instituted an energy credits system, whereby large energy users such as Bitcoin mining companies can be compensated for conserving energy during high demand periods such as this one.

- Ticketmaster announced a partnership with the Flow (+7%) blockchain that will allow event organizers to issue NFTs around live events. These NFTs could enhance fans’ experiences as well as serve as digital collectibles. This is not the first partnership between Ticketmaster and Flow: they previously collaborated to mint 70K virtual commemorative ticket NFTs for Super Bowl LVI. Since then, Ticketmaster has minted over 5M NFTs on Flow for its clients, including The Black Crowes and Sebastian Maniscalco.

Runa Updates:

- In case you missed it, Runa’s COO, Max Williams, published a piece about the Ethereum Merge last month. We believe The Merge is the most important event of 2022 for crypto investors. The Merge will cause a shift in supply and demand that reinforces the investment merits of $ETH in ways digital assets have never seen before.

- Short Video: https://vimeo.com/736301744

- Full Report: https://lnkd.in/gwYNVXze

- Max was featured in Blockworks for this research. Blockworks article: https://blockworks.co/investors-bullish-over-ethereum-merge-disinflation-narrative/

- Runa launched a new website, which includes research, videos, and an overview of our distinct approach to liquid token investing.

Questions? Thoughts? Feedback? Shoot us an email! info@runadigitalassets.com